Which form do I select? (What are differences in the forms)

This FAQ will cover the following forms:

1. Assets - (Balances Favourable to Client)

2. Liabilities (Balances Favourable to the Financial Institution)

3. Contingent Liabilities and Guarantees

4. Derivatives (Including FEC’s)

5. Authorised Transactors / Signatories List

6. Letter of credit

7. Cash Management Systems

8. Securities (Instruments)

9. Bills

Answer:

This provides the user with insight on what the different forms are as per SAAPS 6 and how they would look like on Confirmation.com. It also provides a description on what the forms entail, thereby ensuring that users select and send the correct forms through to the bank.

|

Form

|

Description

|

|

EMEA Consolidated form

|

The consolidated form asks the bank, and its participating departments to perform a search of ALL client data based on the information provided in the template.

NB! This form does not guarantee all client data will be retrieved but asks the responding bank to use best efforts based on data available to them.

|

|

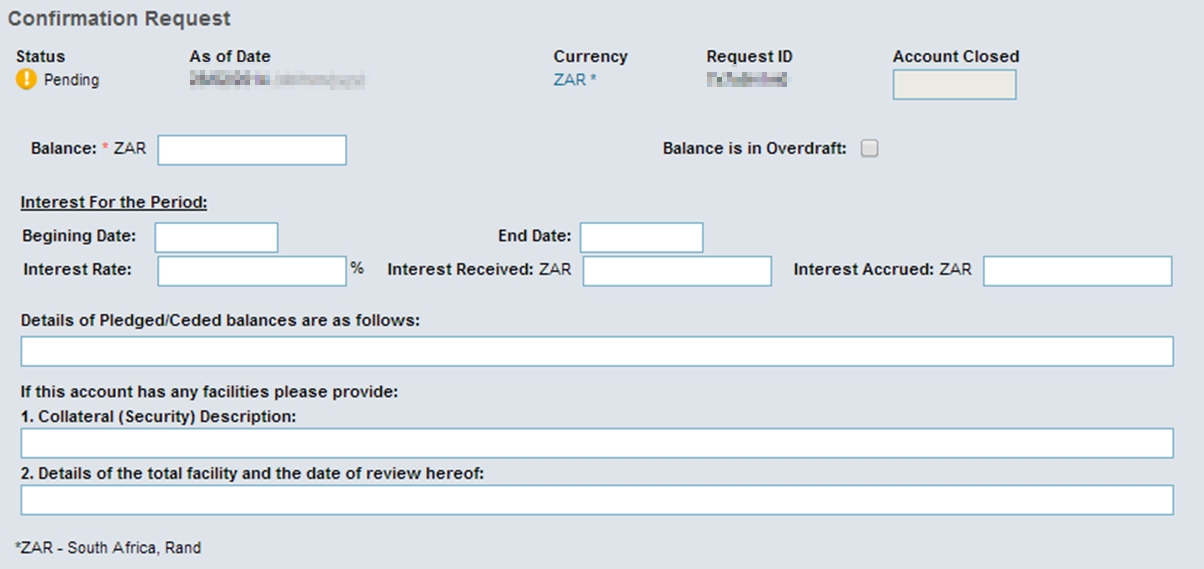

ZA-Asset

|

The ZA-Asset form provides information on balances, interest and any collateral, securities or facilities that may be attached to a account for a specified year end date.

|

|

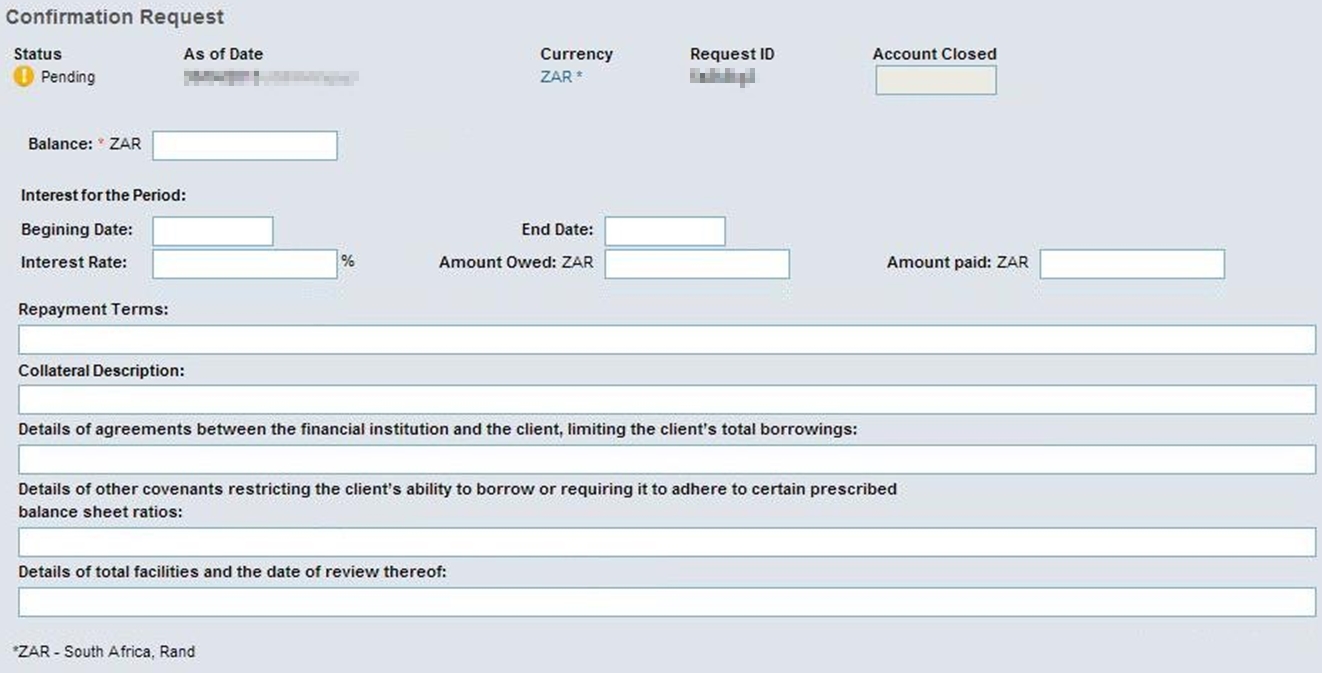

ZA-Liability

|

The ZA-Liability form provides information on balances, interest, covenant details and any collateral, securities or facilities that may be attached to an account for a specified year end date.

NB! Should an account have an attached overdraft facility, the bank will be able to provide this information, as well as the relevant overdrawn balance and interest owed, on the ZA-Asset form.

|

|

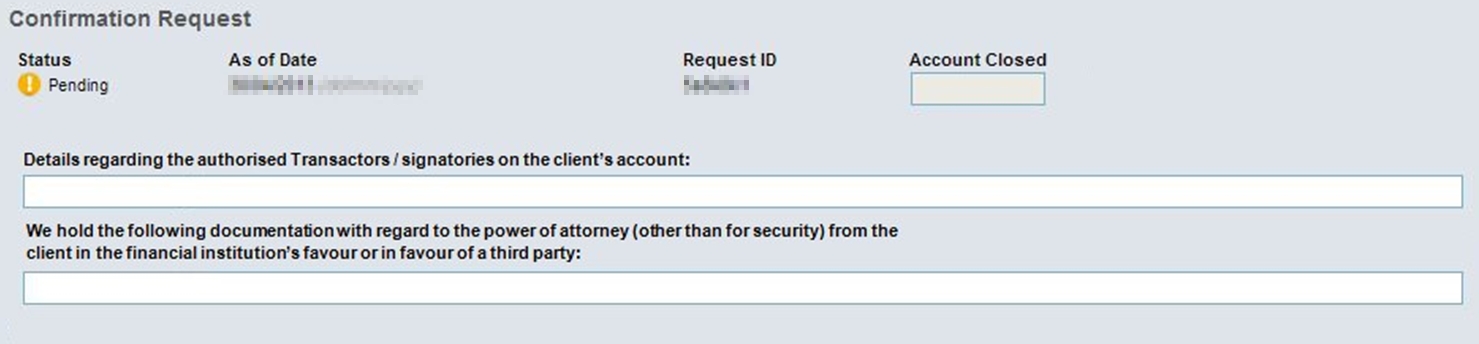

ZA-Signatories

|

The ZA-Signatories form provides a list of authorised signatories on the client account and documentation with regards to the power of attorney.

|

|

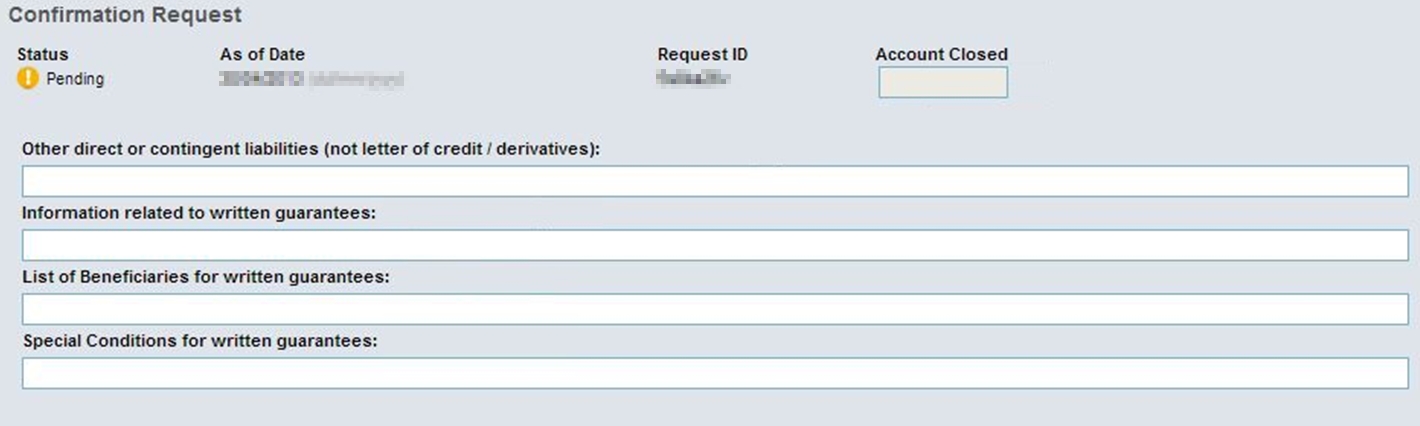

ZA-Contingent Liability & Guarantees

|

The ZA-Contingent Liabilities & Guarantees form provides information on written guarantees and other contingent liabilities.

|

|

ZA- Letter of Credit

|

The ZA-Letter of Credit form provides information in relation to a letter issued by a bank to another bank to serve as a guarantee for payments made to a specified person under specified conditions

|

|

ZA-Derivative

|

The ZA-Derivative form provides information on forward exchange contracts and other derivative positions for a specified year end date.

|

|

ZA-Bills

|

The ZA-Bills form provides information on bills of exchange

|

|

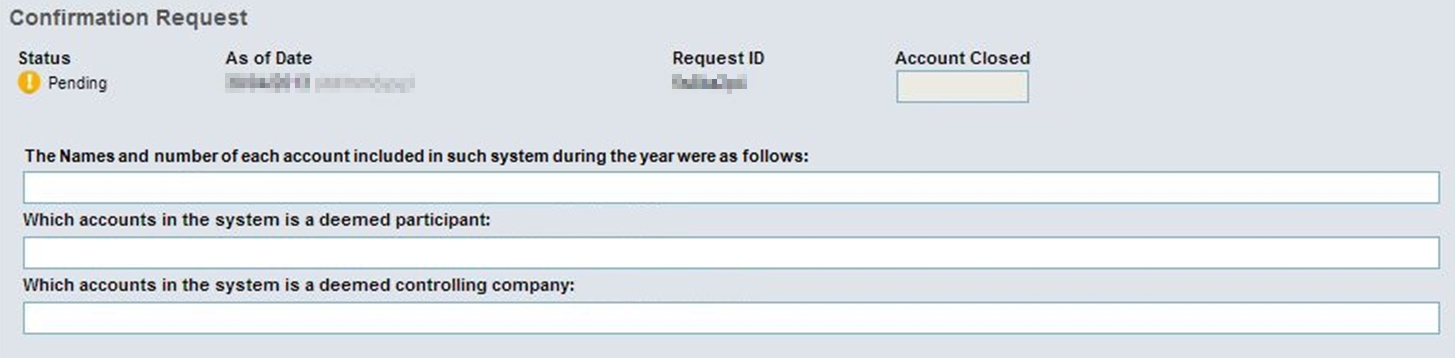

ZA-Cash Management

|

The ZA-Cash Management form provides a list of linked accounts, in a system, at a financial institution where the balances are swept to a main account to accrue a higher interest return.

NB! Account balances are not provided on this form. Balances can be obtained by sending either the ZA-Asset or ZA-Liability form.

|

1. Assets - (Balances Favourable to Client)

Type of information asked for on the asset form: balances on cheque; deposit; saving; investment and other asset accounts of the client and associated interest received by and accrued to client. (Note: This form includes a collateral/security/facility question)

2. Liabilities (Balances Favourable to the Financial Institution)

Type of information asked for on the liability form: balances on loans, advances and other liability accounts of the client and associated interest paid by and owed by the client. (Note: This form includes a collateral/security/facility question)

3. Contingent Liabilities and Guarantees

This form includes questions on Guarantees.

4. Derivatives (Including FEC’s)

Type of information asked for on the derivative form: Derivative contracts, such as foreign exchange contracts, forward rate agreements, financial futures, interest rate swaps, option contracts, bullion contracts, commodity contracts, swap arrangements (near and far dates), credit derivatives including collateralised debt obligations (CDOs), others (state their nature) etc.

5. Authorised Transactors / Signatories List

This form would give you a list of authorised signatories on the client account.

6. Letter of credit

The ZA-Letter of Credit form provides information in relation to a letter issued by a bank to another bank to serve as a guarantee for payments made to a specified person under specified conditions

7. Cash Management Systems

A cash management system is a combination of two or more accounts at a bank or a financial institution where the balances are swept to a main account. A cash management system is used to be able to accrue a higher interest return. This is often found in larger corporate clients, with a number of branches.

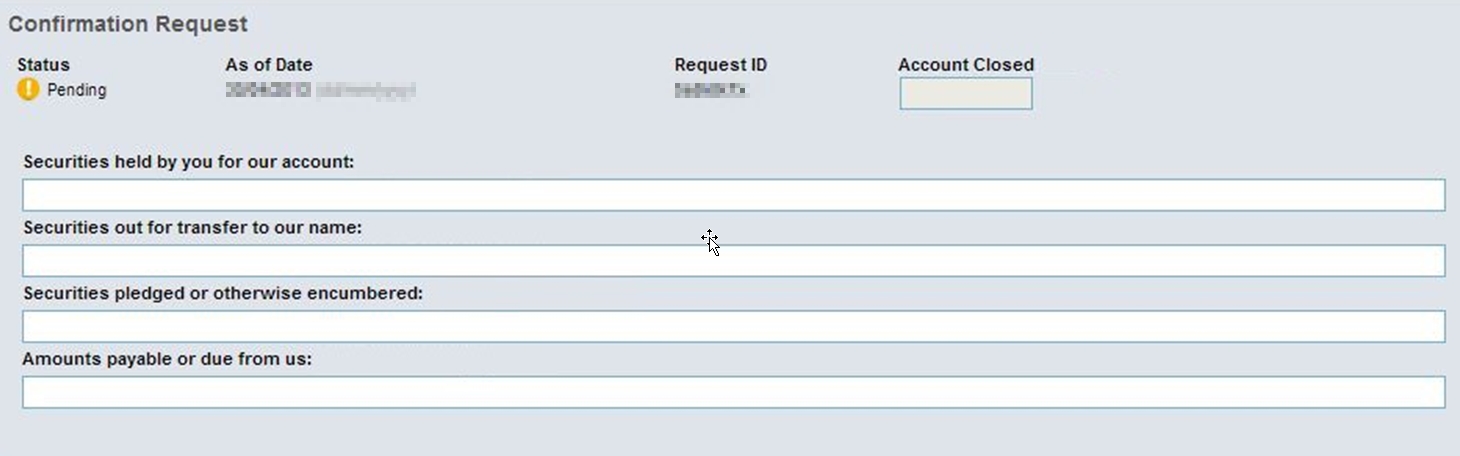

8. Securities (Instruments)

Note: This form is not used to provide Security/Collateral/Surety. This information is provided on the asset or liability form.

Securities (instruments) are broadly categorised into:

- Debt securities (debt securities may be called debentures, bonds, deposits, notes or commercial paper depending on their maturity and certain other characteristics),

- Equity securities, e.g., common stocks (“safe custody assets”),

- Hybrid securities e.g., preference shares (combination of the characteristics of both debt and equity securities), etc.

9. Bills

Type of information asked for on the bills form: Bill (or bill of exchange) – unconditional order in writing addressed by one person to another, signed by the person giving it, requiring the person to whom it is addressed to pay on demand or at a fixed or determinable future time, a sum certain in money to a specified person or his order or to bearer.

Rate this article:

|vote=None|

Processing...

(Popularity = 0/100, Rating = 0.0/5)

Related Articles

Guide ZA-Letter of Credit Form

Guide ZA-Asset form

Manual on SAAPS 6 Forms

Guide ZA-Contingent Liability & Guarantees

Guide ZA-Cash Management Form

view all...