What's New | Probe 2024.20.13

1. Caseware Working Papers 2024

The following describes the features and fixes included in Working Papers 2024 and related products.

1.1 Features

1.1.1 Imports and exports

-

Added support for imports from the following software packages:

- QuickBooks 2024 (Australia, Canada, UK)

- Sage 50 Accounting 2024 (Canada)

-

Added support for exports to the following software packages:

-

The import process for QuickBooks US files now matches the process to import QuickBooks Canada, UK and Australia files. This process requires the QuickBooks Export Utility.

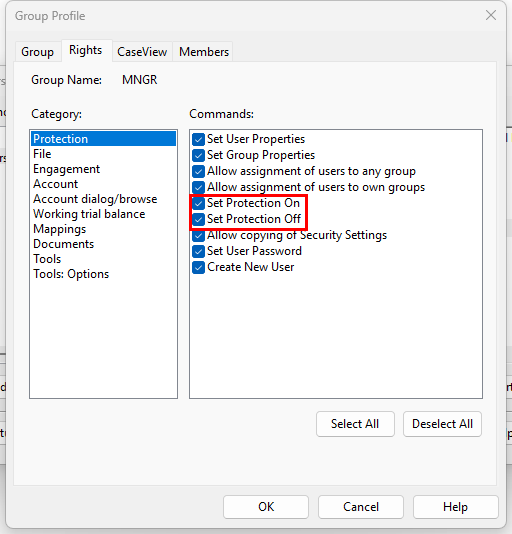

1.1.2 Protection Setup

Split the existing Set Protection On/Off group right into Set Protection On and Set Protection Off. This can be used to expand the number of users that can enable file protection without giving them the ability to disable it.

1.1.3 History and Milestones

1.1.4 Engagement lockdown

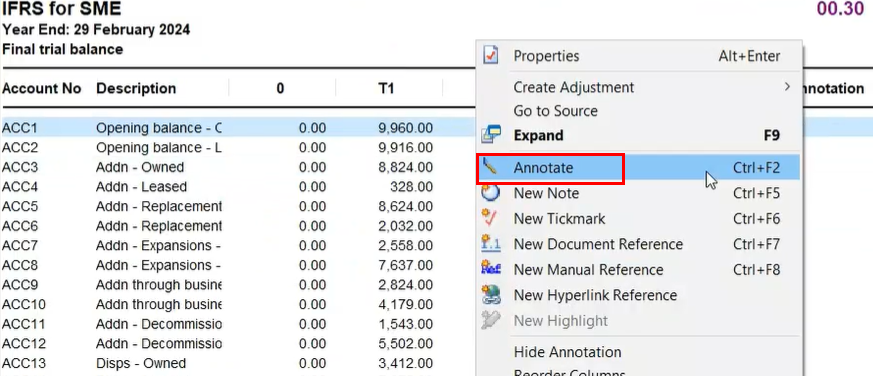

1.1.5 Annotations

The Annotation column is now visible in trial balance automatic documents using the Consolidated view.

1.1.6 More informative Error Messaging

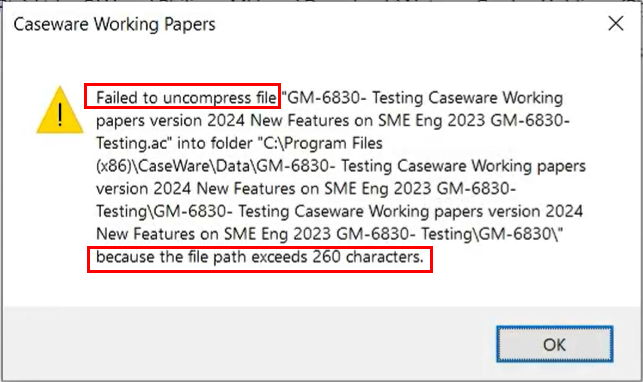

Added a more informative error dialog when attempting to open a compressed file that contains documents with file paths exceeding 260 characters.

1.1.7 Caseview Scripting

1.1.8 Data Store Administrative Tool

1.2 Fixes

2. Universal

2.1 Speed improvements

We have made significant speed enhancements to some of the documents within Probe. Please note that these improvements are only available on new files. You will have to refer to the speed guide for existing files.

The below documents have been enhanced for speed:

|

Document and procedure

|

Percentage enhanced speed

|

|

10.20 - Raising a risk

|

38%

|

|

11.60 - Refresh risk tables

|

91%

|

|

10.51 - On opening the document

|

4%

|

|

11.50 - Linking a risk to a control

|

35%

|

|

Saving the above documents

|

50%

|

2.2 Caseware Q

We have removed Q. This decision was made to improve the overall performance of your files. Q will be replaced by Sherlock, our new and improved tool, which offers enhanced features and better performance. By removing Q, you will notice that your engagement files will close faster, streamlining your workflow and improving efficiency.

3. Audit

3.1 NEW Engagement types

To provide for group audit engagements (refer to par 3.1 below) Probe now provides for the following 4 different engagement types:

|

Engagement type in 10.20

|

Description of engagement type

|

Term used in freeze pane

|

|

Audit – single legal entity

|

A single legal entity with:

There is no consolidation process in preparing this single legal entity's financial statements.

|

AUDIT

|

|

Group audit – single legal entity with multiple business units

|

A single legal entity organised with more than one business unit. The business units have characteristics such as separate locations, separate management, or separate information systems. The financial information is aggregated in a consolidation process in preparing the single legal entity's financial statements.

|

AUDIT GROUP SINGLE

|

|

Group audit – multiple entities

|

A group that consists of more than one entity whose financial information are consolidated. For example, a parent with one or more subsidiaries, joint ventures, or investments accounted for by the equity method

|

AUDIT GROUP MULTIPLE

|

|

Review

|

|

REVIEW

|

Selecting the engagement type is now the first question the user completes, followed by procedures to verify the type of engagement selected. The freeze will continue to distinguish between audit and review, and in the case of audit it will inform the user whether the group audit relates to group audit single or group audit multiple.

The term group audit engagements will be used in the remainder of the document when reference is made to “Audit group single” and “Audit group multiple”.

3.2 Features

3.1.2 NEW Add entity in group audits

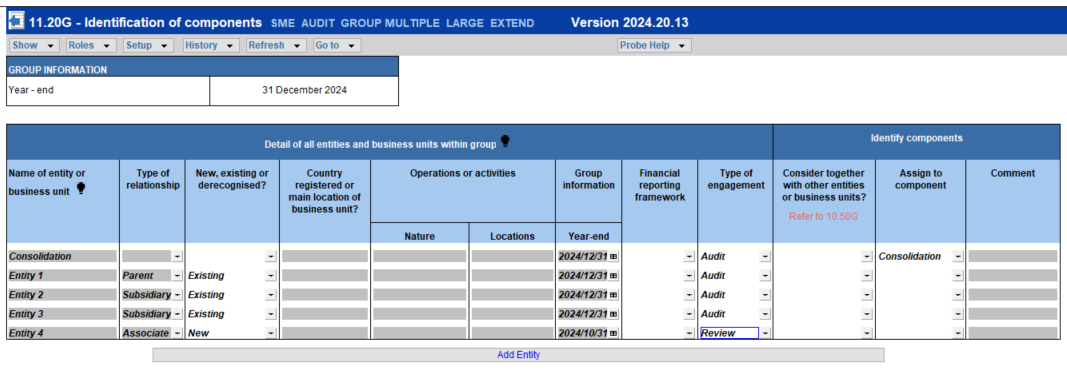

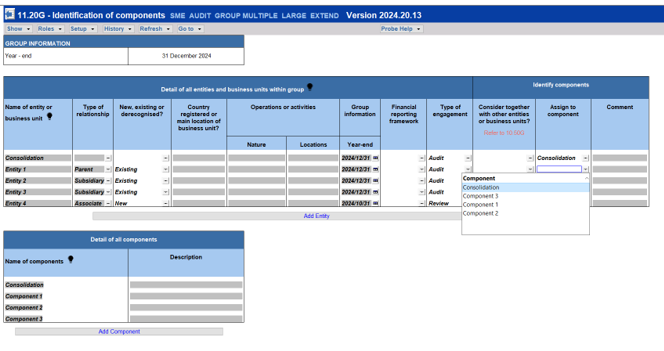

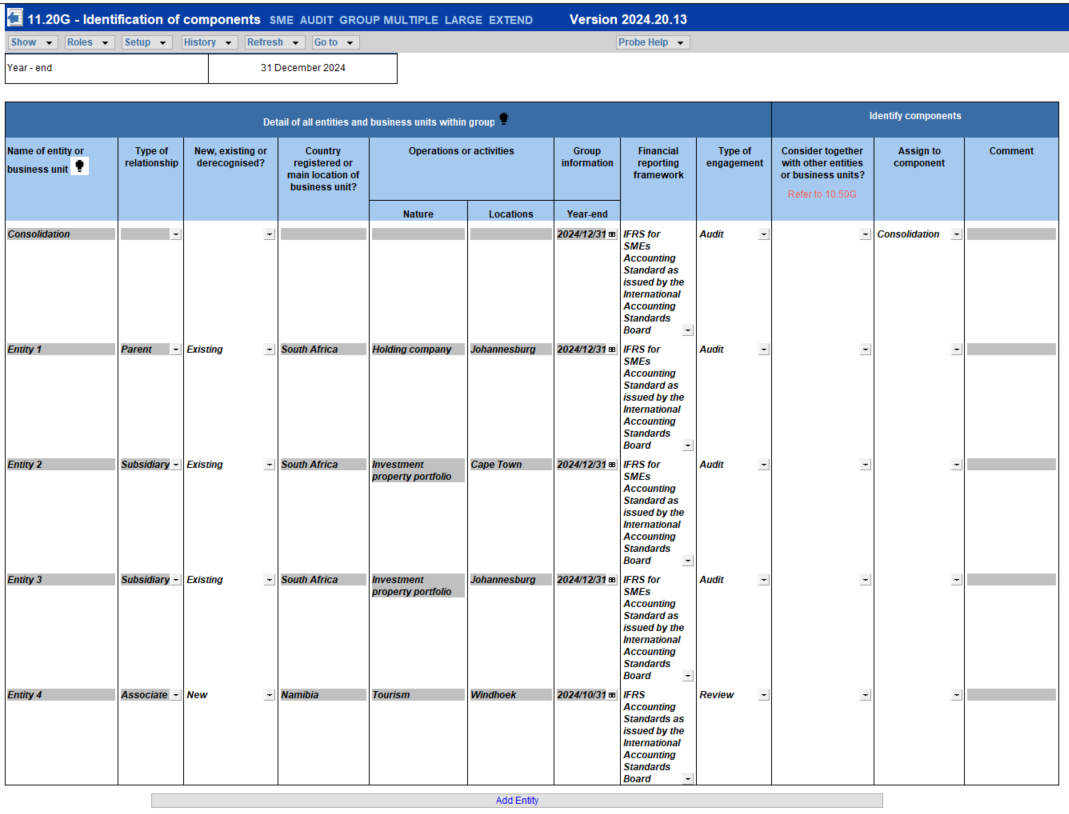

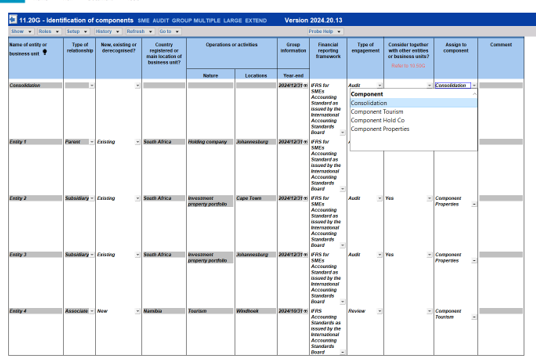

Users can now add entities and business units that form part of the group being audited using the new addition to the risk button. Users click on Risk button and select “Add entity or component”. Users then select “Add entity” in 11.20G Identification of components using the new feature.

After adding the entities and business units in 11.20G Identification of components, users will be able to:

-

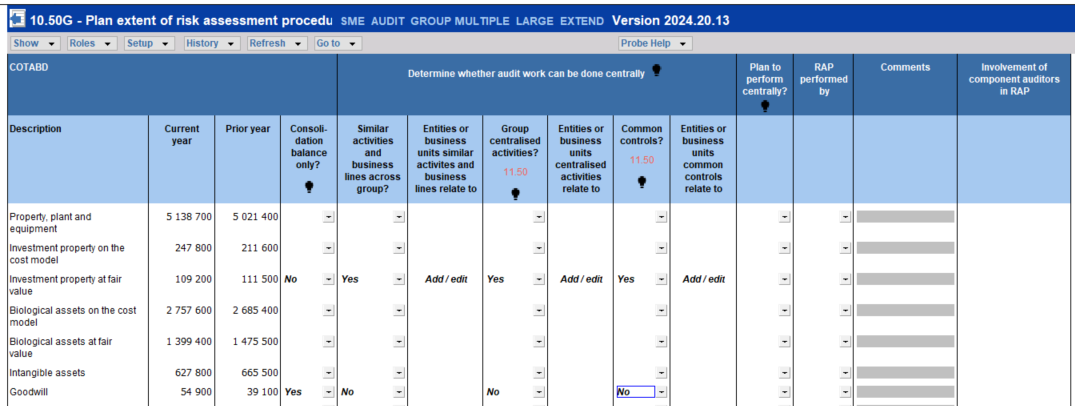

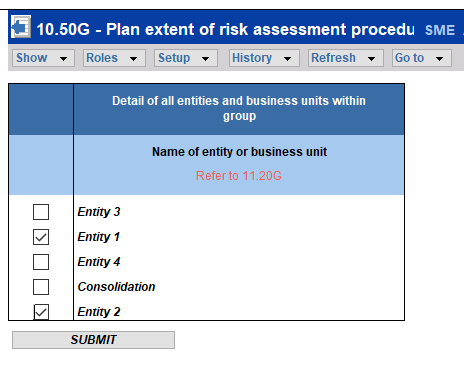

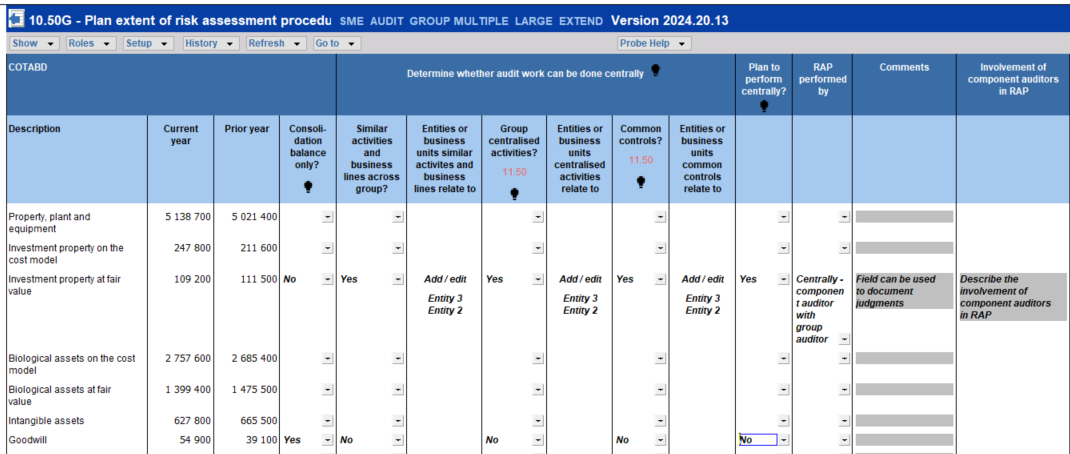

Link the entities of business units to specific COTABDs per column in 10.50G Plan extent of risk assessment procedures. User can click on ‘Add/edit’ which will bring up a different screen with a list of entities and business units recorded in 11.20G Identification of components. If none have been added yet, users can use the link to 11.20G that will take them to the screen that will allow them to add new entities and business units. Users can then return to 10.50G afterwards and link them, as necessary.

Only entities and business units added on 11.20G will be available for selection in 10.50G.

3.2.2 NEW Add components in group audits

Users can now add components (refer to par 3.3.1 for definition of component) using the new addition to the risk button. Users click on risk button and select “Add entity or component”. Users then select “Add component” in 11.20G Identification of components. After adding component(s) users will be able link the entities and business units that were added using “Add entity” to a component.

The description of components will automatically pull through from 11.20G Identification of components to:

Furthermore, the description of the component will pull through to 12.23G Component performance materiality when users selected on 12.20G Further audit work at component level that further audit work is required at that component.

The combine features “Add entity” and “Add component” provides user with the functionality to track work to be performed at entities and business units as well as components.

3.2.3 NEW Add specific performance materiality item

Users can add a COTABD for which specific materiality will be determined using the “Add specific materiality item”. A new line will be added as follows:

3.3 Group audits

Content related to group audit engagements previously scoped out of Probe Audit is added in this release. The content is based on ISA 600 (Revised), Audits of Group Financial Statements (Including the Work of Component Auditors) effective for audits of group financial statements for periods beginning on or after 15 December 2023.

The following key factors were considered in the design of the template for group audit engagements:

-

In which engagement file should the audit procedures expected to be performed by group auditors and component auditors respectively, be included, considering that component auditors could be members of the firm (either the same as the group audit team or different), their network firm, another firm, or a combination thereof.

Taking these key factors into account, the following principle is applied in Probe Audit, after consultation with the CO Forum and customers:

The group audit file only includes audit procedures to be performed by group auditors in their capacity of group auditors. Audit procedures to be performed on components by component auditors is not included in this engagement file.

The objective is to enable group auditors to compile a stand-alone audit file that supports the group auditor’s evaluation as to whether sufficient and appropriate audit evidence has been obtained on which to base the group audit opinion.

3.3.1 Key terms used

-

Component auditors are auditors who perform audit work related to components for purposes of the group audit (ISA 600 (Revised) par 14(i)). All the requirements related to component auditors, for example communication to and from components auditors, applies to the group auditor when they perform work in the capacity of component auditor.

-

Components is an “entity, business unit, function or business activity, or some combination thereof, determined by the group auditor for purposes of planning and performing audit procedures in a group audit” (ISA 600 (Revised) par 14 (b)).

-

Audit work includes risk assessment procedures (RAP) and further audit procedures (test of detail or test of control). When a COTABD balance is the accumulation of financial information of several components further audit work can be done centrally or at component level:

- Centrally. Audit procedures may be designed and performed centrally when sufficient and appropriate audit evidence related to the COTABD can be obtained by testing one population for several components. The balance of the COTABD will not be disaggregated across components. Relevant factors to determine whether further audit procedures can be performed centrally include:

- At component level. The balance of the COTABD is disaggregated across components and audit work at components are required.

-

Consolidation balance only: The balance of a COTABD is only initiated and accounted for through the consolidation process, for example non-controlling interest. The balance is not the accumulation of financial information of entities or business units.

3.3.2 Terms entity vs group

The term to describe the reporting entity in procedures and questions in documents and letters are used as follows:

3.3.3 Group audit only documents

Documents that are intended only for the group audit engagements are identified with a “G” after the number of the document.

A warning will appear in these documents when users selected “Audit Single” or “Review” informing users that the document is only applicable to group audit engagements.

-

Group information interaction

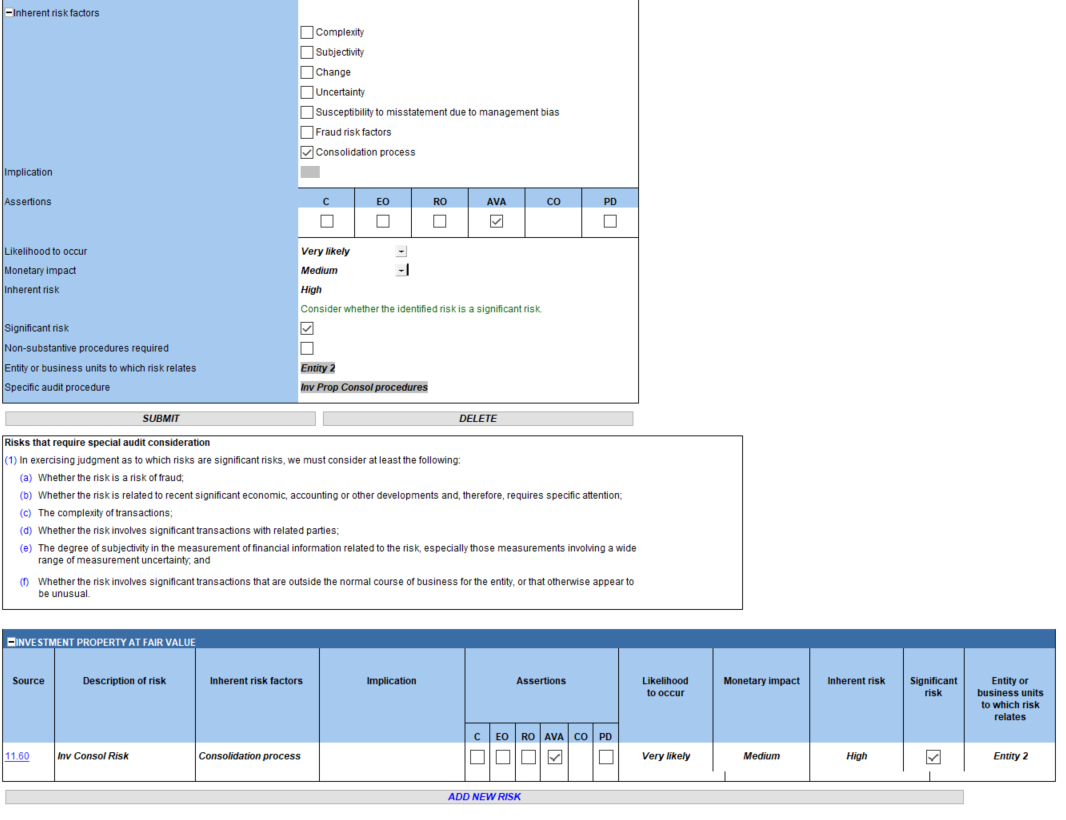

3.3.5 Risk dialog

Two additions have been included to the risk dialog for group audit engagements:

3.3.6 Aggregated or consolidated financial information

The following documents will include the consolidated or aggregated financial information for the group audit engagements when the CWWP consolidation function is used:

Please take note that when the CWWP Consolidation function is used, the balances of COTABDs will only include balances of entities and business units. It does not include the balances of components, unless every entity or business unit is treated as a component. Components are not necessarily a reflection of the legal structure used to consolidate; components can be a combination of entities or business units. Refer to par 3.3.13 for further information on identification of components.

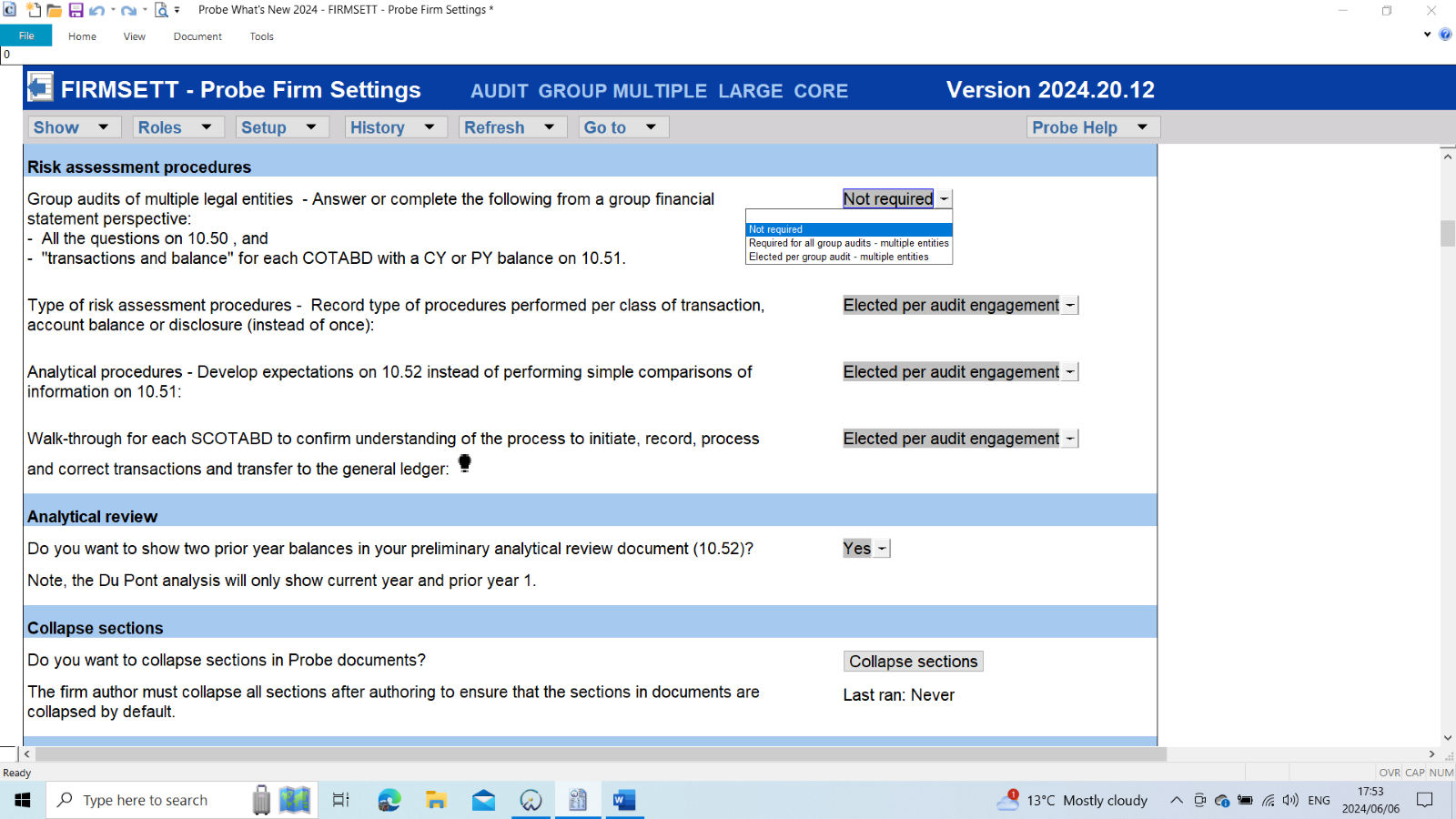

3.3.7 FIRMSETT Probe Firm Settings

|

Matter identified

|

ISA ref

|

Comment

|

|

FIRMSETT – Probe Firm Settings

|

|

Risk assessment procedures

|

|

Firms can elect the extent to which audit teams of Audit Group Multiple answer or complete the following from a group financial statement perspective:

Firms can elect that the answering or completion is:

Refer 3.3.15 for further detail of the effect of the election on the content in 10.50 Gathering of information and 10.51 Types and volumes of transactions.

|

3.3.8 Pre-engagement planning

|

10.20 Engagement evaluation

|

|

Engagement type

|

ISA600.4

|

The “engagement type” question now includes the four engagement types. Refer 3.1 for descriptions of the engagement types.

Questions to verify the type of engagement is included after “Engagement type”.

After completing the verification questions, users will be asked to confirm the appropriateness of the engagement type selected.

|

|

Management and TCWG

|

|

The default description of management and those charged with governance (hereafter referred to as TCWG) for Audit Group Multiple is “group management” and “those charged with governance of the group”.

Users should consider the appropriateness of the description based on their understanding of the group and amend accordingly to ensure that the engagement file is updated with the appropriate descriptions.

|

|

Components

|

ISA600.17 & 18

ISA600.22(a)

ISA600.22(b)

ISA600.23

|

Questions for the group audit engagements were added to:

Take note of the red warnings that informs the users where key information should be recorded, and the blue text in the description column that advise users where the understanding may be documented.

Refer to par 3.3.13 for a further explanation about the identification of components.

|

|

Terms of engagement

|

ISA600.19

|

Preconditions of the audit have been updated for the group audit engagements to include questions related to:

|

|

Compliance Add-on module

|

|

The question will appear for Group Audit Multiple for both Audit Large and Audit Small providing group auditors with the option to include or exclude the Companies Act procedures in the engagement file.

Refer par 3.3.21 for explanation of change.

|

|

Conclusion related to preconditions of an audit

|

ISA600.20

|

The conclusion that the preconditions of the audit are not present, will also appear in the group audit engagements when the following questions under “Preconditions” are answered “No”:

Users will also be prompted that when law or regulation prohibit them from declining the engagement,

-

they should consider their responsibility by law or regulation to communicate with regulators, listing authorities, or others, about the restrictions.

|

|

10.21

|

|

The paragraph related to responsibilities o

|

|

Responsibilities of the group management

|

ISA600.19(b)

|

The sub procedure relating to ‘You will retain responsibility and accountability for:’ was updated to include “or component management’.

|

|

10.30 Discussions with those charged with governance

|

|

Obtain understanding of group and its environment

|

ISA600.A34

|

The following questions were added for group audit engagements:

|

|

10.50 Gathering information

|

|

Plan extent of risk assessment procedures (RAP)

|

ISA600.5

ISA600.30(c) (i)&(ii)

|

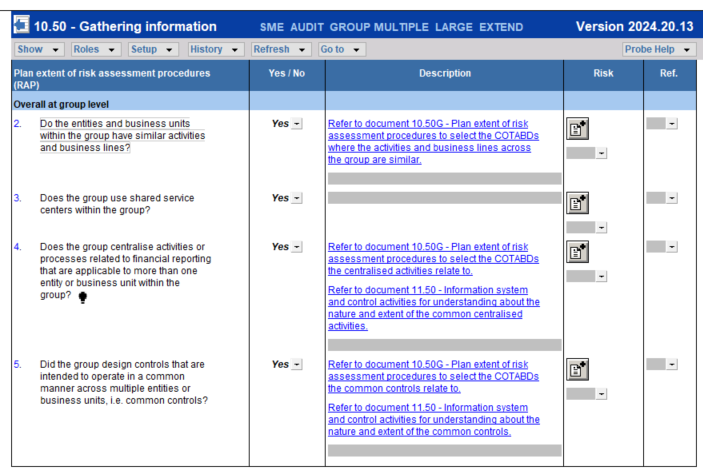

A new section ”Plan extent of risk assessment procedures” is added for group audit engagements to determine whether:

Users are prompted to complete 10.50G (New) Plan extent of risk assessment procedures to make the above determination per COTABD.

The responses to the questions in section “Plan extent of risk assessment procedure”

Refer to par 3.3.14 and 3.3.16 for more detail.

|

|

Activation of questions following new section ”Plan extent of risk assessment procedures”

|

|

Only when users answer “Yes” to the following question on 10.50 the other questions on 10.50 will appear:

“Did we determine whether:

- The relevant COTABDs are only initiated and accounted for through the consolidation process, and

- Further audit work for relevant COTABDs will be performed centrally, i.e. audit evidence can be obtained by testing one population for several components?”

|

|

Inclusion of questions in 10.50 for Group Audit Multiple

|

|

When the firm elected that the group audit team should determine the extent to which the questions in 10.50 Gathering of information and the sub-section "Transactions and balance" of COTABD should be answered or completed, a question will appear in 10.50:

“Are we planning to complete the following from a group financial statement perspective:

Par 3.3.15 explains when questions related to COTABDs will be included for Group Audit Multiple.

|

|

Inclusion of questions in 10.50 for Group Audit Single

|

|

All the questions will always be included for Audit and Group Audit Single.

|

|

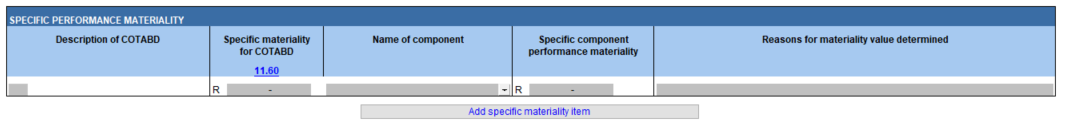

10.50G (New) Plan extent of risk assessment procedures

|

|

Determine Involvement of component auditors

|

ISA600.22(a)

|

The objective of 10.50G (New) Plan extent of risk assessment procedures is to determine per COTABD whether:

The responses to the questions in the new section ”Plan extent of risk assessment procedures” in 10.50 Gathering information determines the inclusion of applicable columns in 10.50G.

The responses per COTABD in 10.50G Plan extent of risk assessment procedure

|

|

Entities or business units centralised activities, common controls relates to and where audit work will be performed centrally

|

|

For each COTABD where centralised activities or common controls occur and where the group auditor plan to perform audit work centrally, the user will select from a list of entities and business units added on 11.20G, to which entities and business units it applies. Refer to feature explained in par 3.2.

|

|

Estimates

|

|

For group audit engagements the question to determine whether balances in the group financial statements are based on accounting estimates or fair value measurements, is included under new section ”Plan extent of risk assessment procedures”.

When answered “Yes”:

|

|

10.51 Types and volumes of transactions

|

|

|

|

The "lead sheet" and "Identify possible ROMM” sub sections

|

|

These sub-sections will continue to be included for each COTABD with CY and PY balance for all audit engagement types.

|

|

Inclusion of "Transactions and balances" sub-section - Group Audit Multiple

|

|

For Audit Group Multiple, the sub-section “Transaction and balances” will appear based on:

When either the firm or the group audit team selected that “Transaction and balances” should be completed for all COTABD with CY and PY balances, the sub-section will be included. Par 3.3.15 provides a further explanation.

|

|

Inclusion of "Transactions and balances" sub-section - Group Audit Single

|

|

In case of Group Audit S and Audit S the sub-section “Transaction and balances” will be included for each COTABD with CY and PY balance.

|

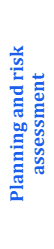

3.3.9 Planning and risk assessment procedures

|

Matter identified

|

ISA ref

|

Comment

|

|

11.20 Inherent risk assessment

|

|

Understanding of the group and its environment, and the applicable financial reporting framework

|

ISA600.30 (a) & (b)

|

Par paragraph 30 and 33 of ISA 600 (Revised) commence with “in applying ISA 315 (Revised 2019), the group auditor shall take responsibility for obtaining an understanding.”

Therefore, the requirements of ISA 315 (Revised November 2019) were retained and the requirements of ISA 600.30 (a) & (b) was added, including

|

|

Group organisational structure and ownership

|

ISA600.30 (a)(i)

|

The user will be required to complete 11.20G (New) “Identification of component auditors”.

|

|

11.20G Identification of component auditors

|

|

|

ISA600.30 (a)(i)

ISA600.30 (b)

|

Only applies to the group audit engagements.

The objective of the document is to:

Use the new features “Add entity” and “Add component” to add entities and business, and components respectively. Only entities and business units as well as the components added on 11.20G will be available for selection in other documents such as 10.50G and 12.20G.

Refer to 3.3.13 for information about the identification of components.

|

|

Consolidation – default entity and component

|

|

Consolidation is added as a default entity and default component.

It is added to facilitate the workflow related to audit work for COTABDs that are not an aggregation of financial information of one or more entity or business unit. It is initiated through the consolidation process. Example may be Goodwill and Non-controlling interest.

|

|

11.25 Fraud risk assessment

|

|

|

|

For the group audit engagements existing procedures were updated to make the wording more appropriate to group audits.

|

|

11.30 Evaluation of system of internal control

|

|

Understanding of the group’s system of internal control

|

ISA315 (Revised 2019)

|

Refer comment to 11.20 above related to the requirements of ISA 315 (Revised 2019).

Therefore, all the procedures that address the requirements of ISA 315 (Revised November 2019) were retained. Minor amendments were made to existing procedures for the group audit engagements for more appropriate wording.

|

|

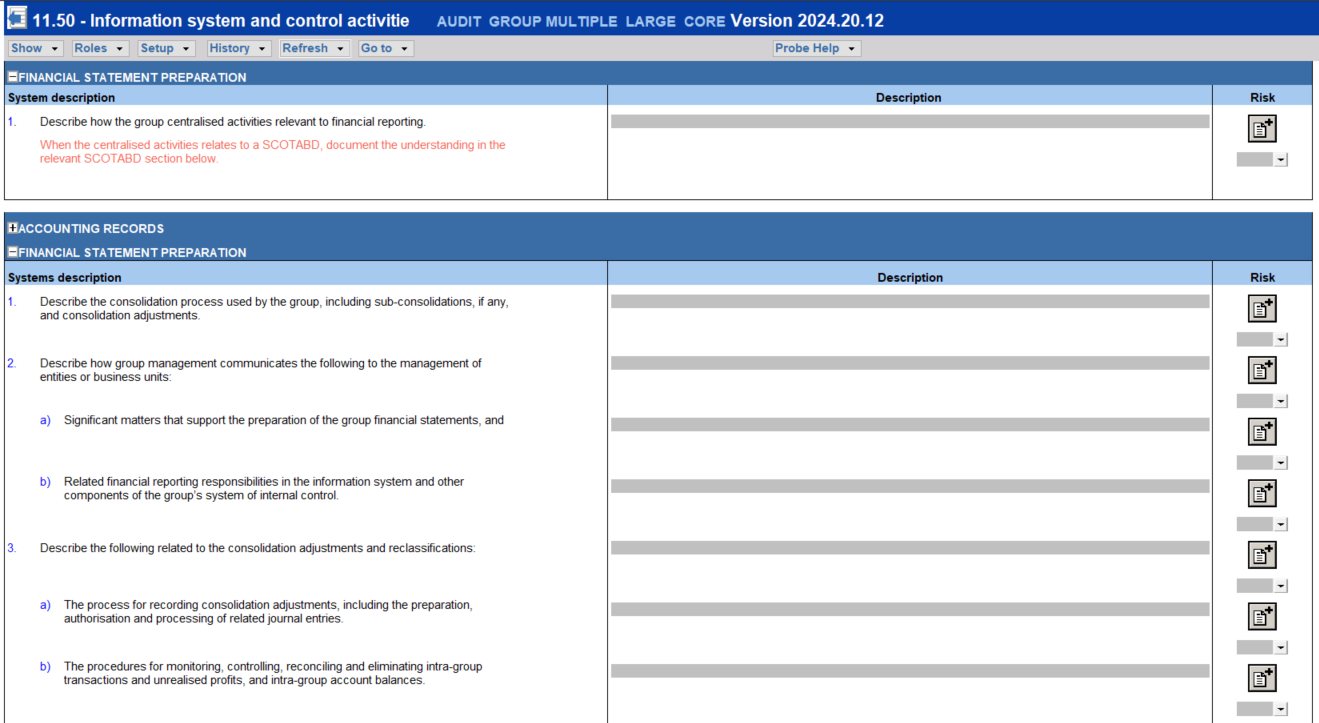

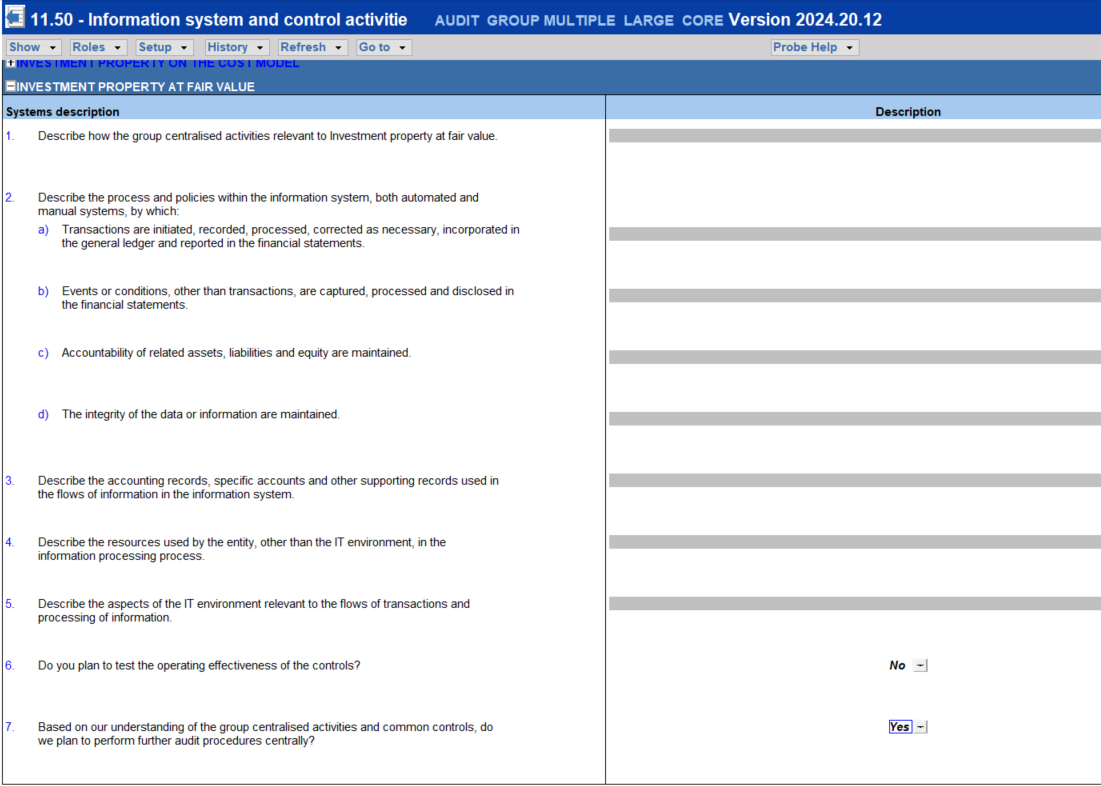

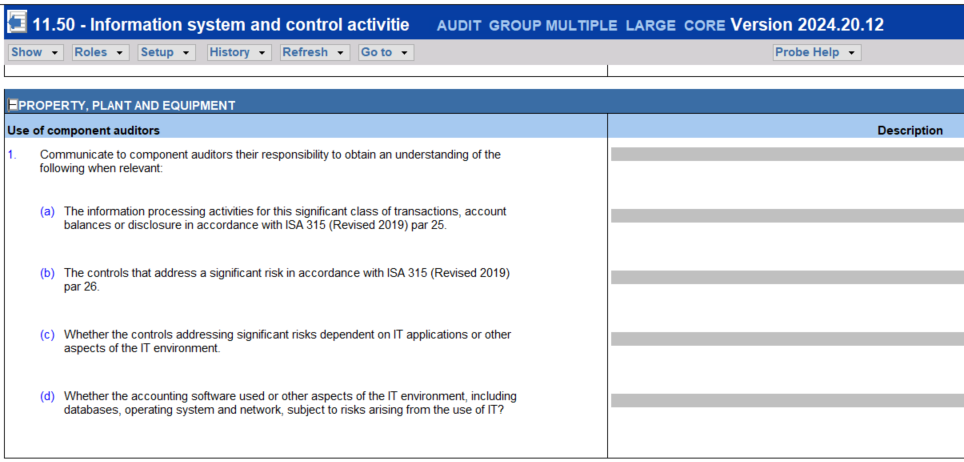

11.50 Information system and control activities

|

|

Centralised activities and common controls

|

ISA600.30 (c)(i)&(ii)

|

A new section “Centralised activities and common controls” is added with audit procedures that prompts the group auditor to obtain an understanding of the nature and extent of common controls and group centralised activities.

The inclusion of the section and procedures within the section will be based on the responses to questions in section ”Plan extent of risk assessment procedures” on 10.50 Gathering of information.

The user will not be able to disable the “Centralised activities and common controls” when they have indicated on 10.50 that the group has common controls and centralised activities.

Additional content based on Appendix 2 par 6 of ISA 600 (Revised) are included for the Extended User.

|

|

Financial statement preparation

|

ISA600.30(c) (iii)&(iv)

|

This section now includes audit procedures that require the group auditor to obtain and document and understanding of the consolidation process.

|

|

SCOTABD

|

|

The procedures related to obtaining the understanding of the information system as required by ISA 315 (Revised 2019) par 25 and 26 will be included for each SCOTABD when the users elected on 10.50G that:

For the other SCOTABD sections, the group auditor will be prompted to communicate to component auditors their responsibility to obtain the understanding required by ISA 315 (Revised 2019).

Refer to par 3.3.16 for a further explanation.

|

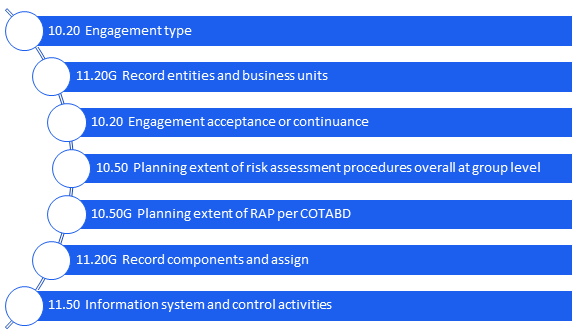

3.3.10 Audit planning

|

Matter identified

|

ISA ref

|

Comment

|

|

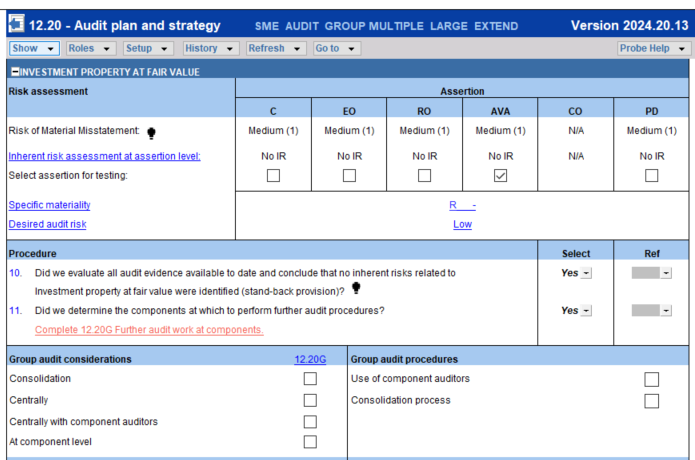

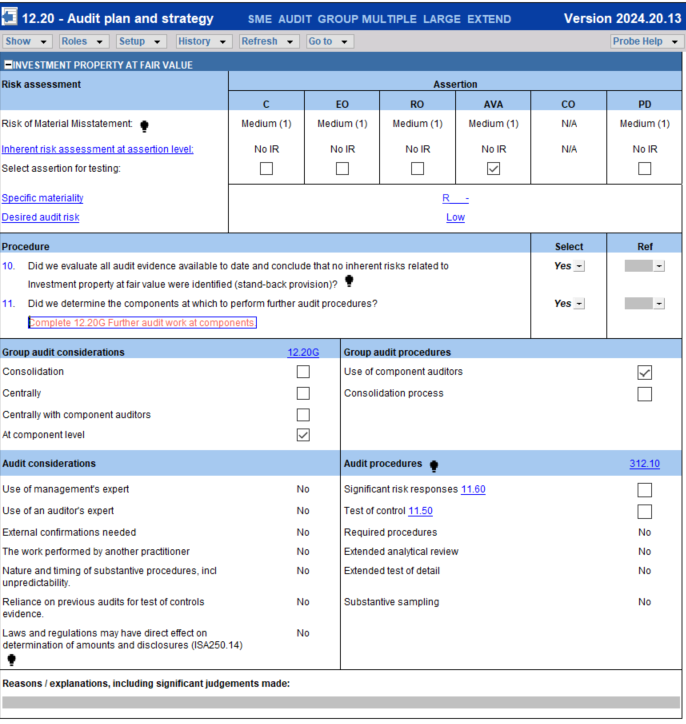

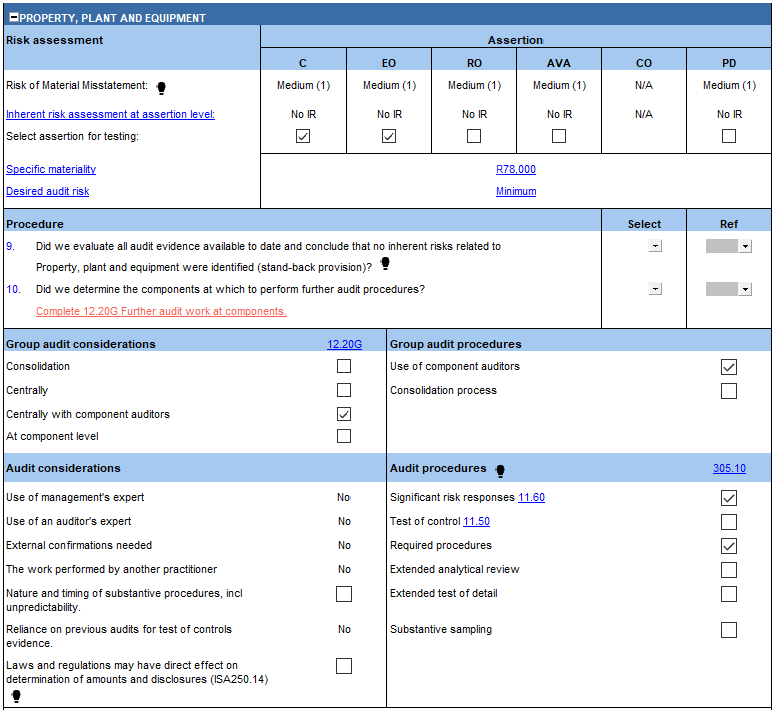

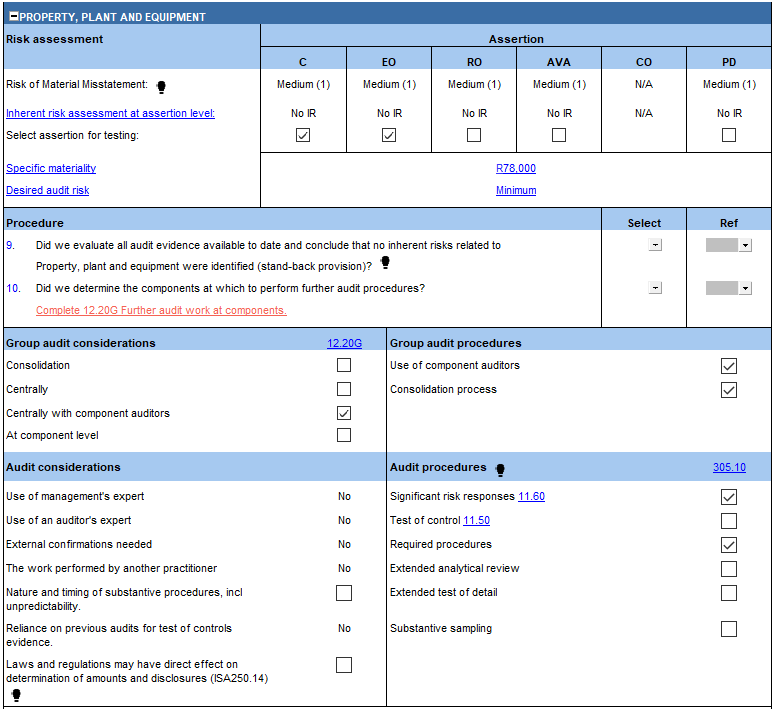

12.20 Audit plan and strategy

|

|

Determine at which component audit work will be performed

|

|

For group audit engagements users will be required to complete 12.20G (New) Further audit work at components and then answer the following question upon completion “Did we determine the components at which to perform further audit procedures?”

For material COTABD the above question will only be included after the assertion was selected.

|

|

Group audit considerations

|

|

A new sub-section “Group audit consideration” is added for the group audit engagements with the options consolidation, centrally, centrally with component auditors and at component level.

The group auditor’s determination at which level audit work will be performed in 12.20G (New) Further audit work at components will pull through to 12.20.

Users will not be able to override the selection. Any changes related to the level at which audit work should be performed, should be recorded on 12.20G.

|

|

Group audit procedures

|

|

A new sub-section “Group audit procedures” is added for the group audit engagements.

Two new audit procedures are included for the group audit engagements, namely:

“Use of component auditors” on 12.20 Audit plan and strategy will be auto-ticked when users elected on 12.20G (New) Further audit work at components that audit work for SCOTABDs or material COTABDs should be done either

Audit procedures related to use of component auditors will be included in the relevant work program.

When “Consolidation process” is selected as inherent risk factor when a risk is recorded, the “Consolidation process” on 12.20 Audit plan and strategy for the relevant COTABD will be auto-ticked.

The group auditor will be required to formulate and record audit procedures on the relevant work program to respond to the inherent risk related to the consolidation process.

|

|

Audit procedures

|

|

When users elected that audit work for a SCOTABD or material COTABD will only be done at component level, the following audit procedures will not be available for selection:

“Required procedures” will not be auto-ticked and will also not be available for selection. The audit work for the relevant COTABD will be performed at component level.

|

|

Audit considerations

|

|

When group auditors determined that further audit work will only be performed at component level for a particular COTABD, the audit considerations such as “Laws and regulations may have direct effect on determination of amounts and disclosures (ISA250.14)” will be answered “No”. Other examples include “Use of management expert”, “External confirmation” and “Nature and timing of substantive procedures, incl unpredictability.”

When group auditors determine that further audit work will only be performed at component level, it is expected that the group auditor will only evaluate the work performed by component auditors and if relevant consolidation process procedures when an inherent risk related to the consolidation process for that COTABD has been raised.

The same applies to the following items:

|

|

Conclusion

|

ISA600.34

|

For the group audit engagements additional completion questions are added for the group auditor to consider whether

|

|

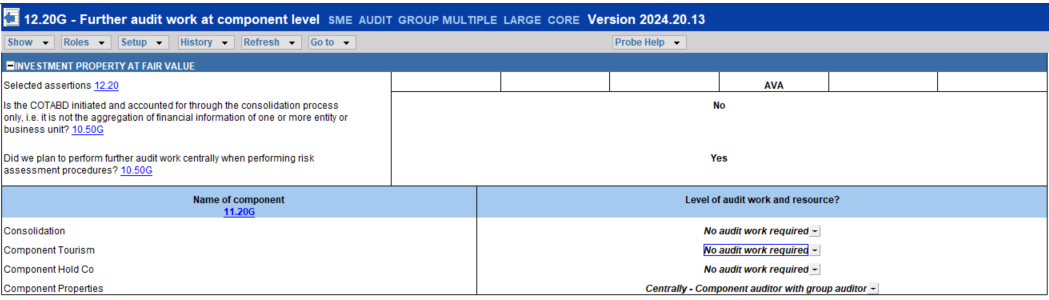

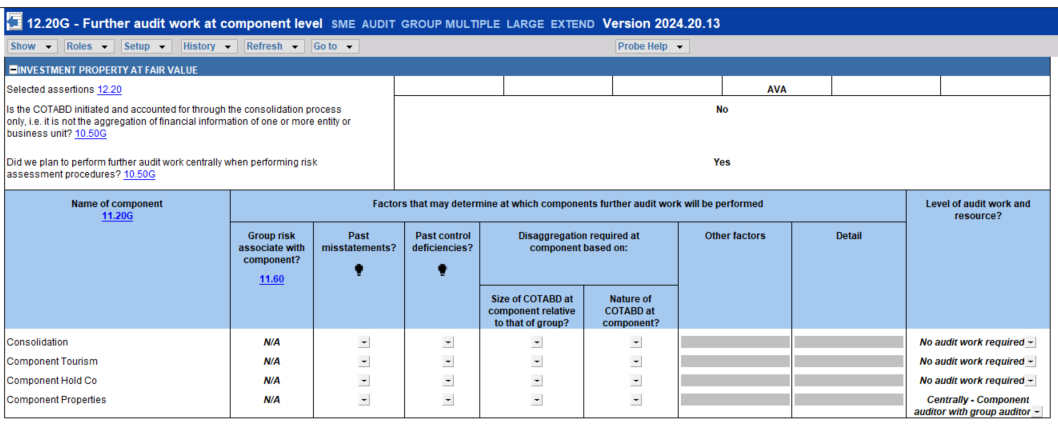

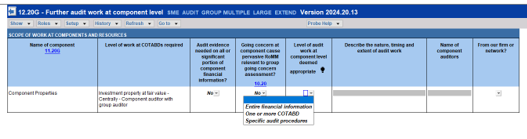

12.20G (New) Further audit work at component level

|

|

Inclusion and objective of 12.20G (New)

|

|

Only applies to the group audit engagements.

The objective of the document is to determine for each SCOTABD and material COTABD:

|

|

Material COTABDs

|

|

To enable the content of a section at least one assertion for the material financial statement item must be selected in 12.20.

If not yet selected, a warning will appear “Select at least one assertion for the material financial statement item (ISA 330.18) in 12.20”.

|

|

Assertions

|

|

User can distinguish between SCOTABD and (only) material COTABD through the description of the assertions pulling through from 12.20. In case of a SCOTABD the term “Relevant Assertions” is included and for material COTABD the term “Selected Assertions” shows.

|

|

Inclusion of components

|

|

The description of components added on 11.20G will pull through to 12.20G. Users can use the hyperlink to 11.20G to add newly identified entities and business units, or components.

|

|

Components at which further audit work is required

|

ISA600.22(a)

|

For each SCOTABD and material COTABD the group auditor determines whether audit work at a component is necessary, and at which level the work should be performed. They select from the following dropdown options:

The matters that may influence the group auditor’s determination at which component(s) further audit work may be required (per ISA 600.A51) are included for the Extended User.

Refer to par 3.3.17 for further detail.

|

|

Scope of audit work and resources

|

ISA600.37

|

The components where further audit work is required to be performed by component auditors, with or without the group auditor, will pull through to “Scope of work at components and resources”.

For each of these components, the group auditor describes the nature, timing and extent of audit work component auditors should performed.

|

|

Scope of audit work and resources – Extended users

|

ISA600.A133

|

The extended users are provided with a summary of the level of audit work per COTABD that is required to be performed per component.

Extended users will be prompted to:

-

Consider the factors whether it is appropriate to perform further audit procedures on the entire financial information of the component (ISA 600 (Revised).A133).

-

Determine at which level the audit work should be performed at the component. Users will select form entire financial information, one or more COTABD, and specific audit procedures.

-

Document detail of the component auditors.

|

|

12.22 Use of resources

| | |

|

Consideration of use of component auditors

|

|

The user will be required to complete 12.22G (New) and answer the following question upon completion:

Did we complete 12.22G Use of component auditors?

|

|

12.22G (New) Use of component auditors

|

|

Inclusion and objective of 12.20G in engagement file

|

ISA600.22(a)

ISA600.37

ISA 600.25(a) read with ISA220.17

ISA 600.16(a) read with ISA220.14

ISA600.29

ISA600.31(a)

ISA600.26(a) &(b)

ISA600.43

ISA600.49

ISA600.53(a) &(b)

|

Only applies to the group audit engagements.

The objective of the document is to provide the group auditor with a checklist to check whether they have met their responsibility as group auditor in accordance with ISA 600 (Revised), including whether they have:

-

Determined the components at which audit work, including RAP and further audit work, will be performed, and as the resources needed.

|

|

Determination per component

|

|

The design of the document recognises that there may be more than one component and that the group auditor needs to determine whether they have executed their responsibilities as group auditor related to each component and component auditor.

Therefore, users are required to complete a question under “Pre-planning and risk assessment procedures” and after “Conclusion”, whether all the questions have been completed considering each of the identified components.

The description of components will pull from 11.20G.

|

|

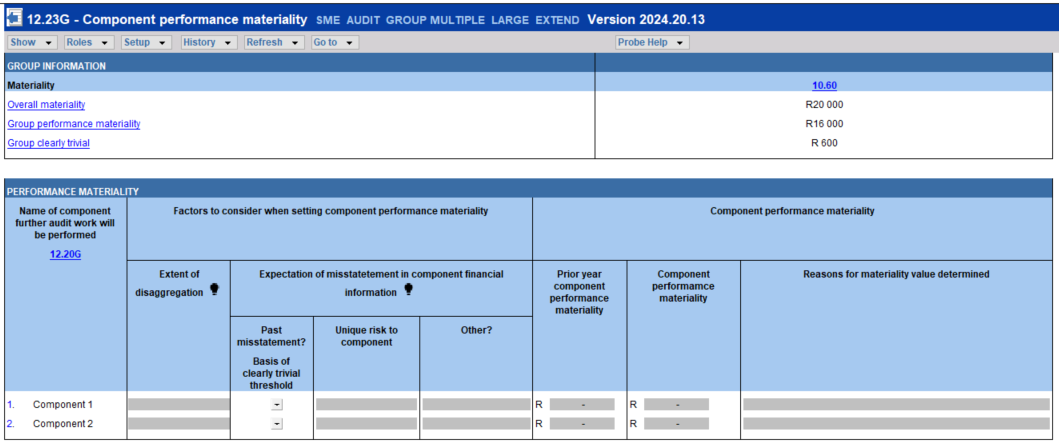

12.23GG (New) Component performance materiality

|

|

Inclusion and objective of 12.20G in engagement file

|

ISA600.53(a)&(b)

|

Only applies to the group audit engagements.

The objective of the document is to determine:

The reason(s) of above determination should be documented.

|

|

Performance materiality - Components where further audit work will be performed

|

ISA600.53(a)

|

For each of the components where audit procedures are performed on financial information that is disaggregated, the group auditor should determine and document component performance materiality.

The components where further audit work will be performed will pull through from 12.20G.

|

|

Performance materiality – Determination

|

ISA600.53(a)

ISA600.A118

|

ISA 600.A118 states “The determination of component performance materiality is not a simple mechanical calculation and involves the exercise of professional judgment.”

Therefore, the “Component performance materiality” is an input field.

A warning will appear when the component performance materiality for an individual component exceeds group performance materiality.

The factors that the group auditor may consider when setting component performance materiality, in accordance with ISA 600.A118, are included for the Extended User.

|

|

Specific performance materiality

|

ISA600.A117

|

Users can record the COTABD for which they deem it relevant to determine specific performance materiality using the “Add specific materiality item” feature.

Users capture the description of the COTABD, and the specific materiality determined for that COTABD on 11.60

A warning will appear when the specific component performance materiality determined for the COTABD exceeds the specific group materiality for the COTABD.

The components where further audit work will be performed will pull through from 12.20G. Users can select these components from a dropdown list.

|

|

Threshold to be communicated

|

ISA600.53 (b)

|

A warning will appear when the threshold exceeds group clearly trivial.

|

|

Conclusion

|

|

Users conclude whether they sufficiently considered the aggregation risk when setting component performance materiality.

|

|

12.30 Planning memorandum

|

|

|

|

Leadership responsibilities for managing and achieving quality on a group audit

|

ISA600.23

|

The partner declaration, which is where the engagement partner illustrates taking overall responsibility for managing and achieving the quality on the audit, has been updated with further declarations based on the “engagement partner shall” paragraphs in ISA 600 (Revised), that applies to the audit plan and strategy.

For example, that the engagement partner evaluated whether the group auditor will be able to be sufficiently and appropriately involved in the work of the component auditor.

|

3.3.11 Execution

|

Matter identified

|

ISA ref

|

Comment

|

|

Work programs of COTABD

|

|

|

|

Work programs will be included in the group audit file for all SCOTABD and material COTABD, similar to the previous versions.

|

|

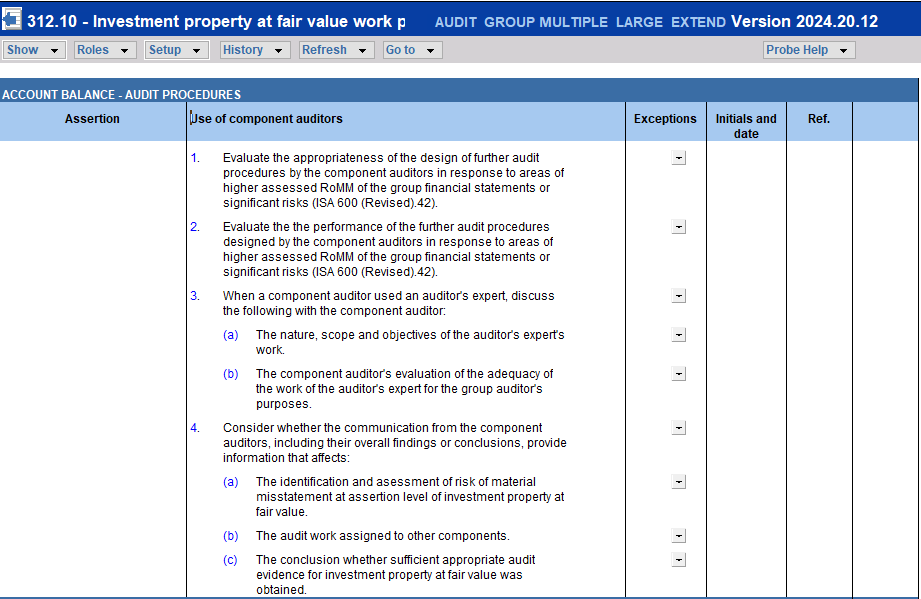

Use of component auditors

|

ISA600.42

|

New audit procedures related to use of component auditors will be included in the work program when the “Use of Component Auditors’ are auto-ticked on 12.20. Refer to changes to 12.20 above for when “Use of Component Auditors’ will be auto-ticked.

The user will be required to complete “Assurance obtained” for “Use of component auditors”.

|

|

Consolidation process

|

|

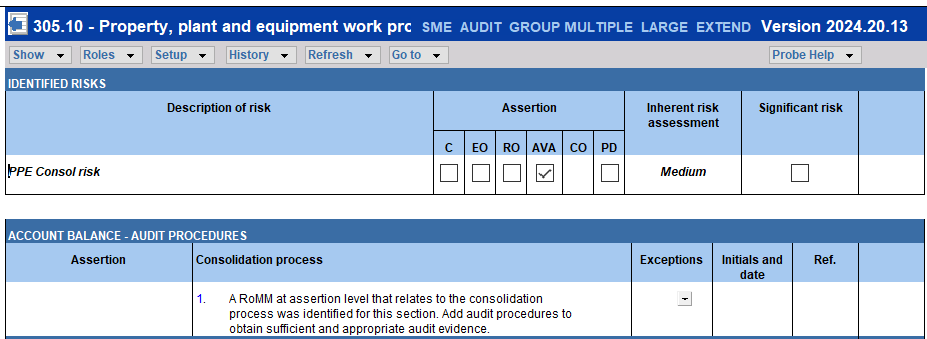

When “Consolidation process” is auto-ticked on 12.20, the relevant work program will include a prompt to add audit procedures to obtain sufficient and appropriate audit evidence to address the ROMM at assertion level that relates to the consolidated process.

The user will be required to complete “Assurance obtained” for “Consolidation process”.

|

|

Conclusion questions

|

ISA600.18

ISA600.57(b)

ISA600.56

ISA600.48

|

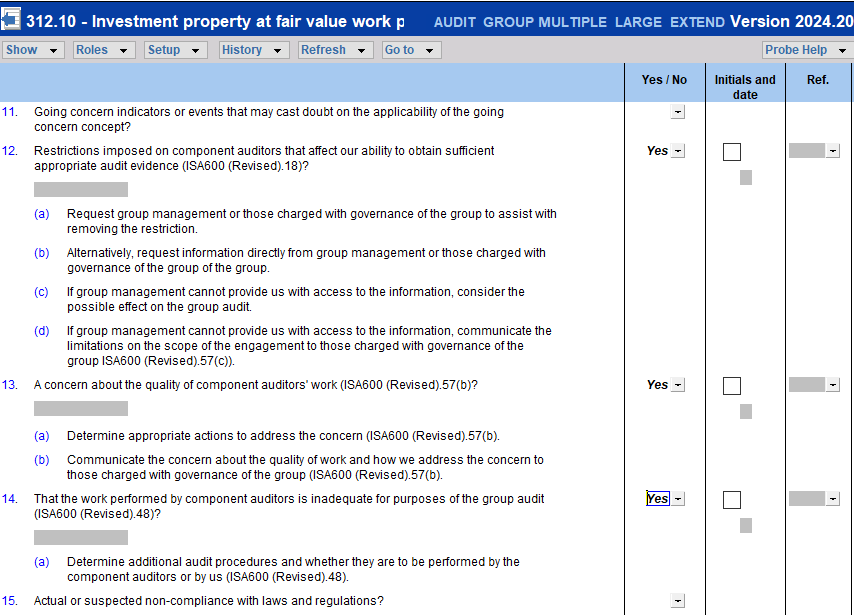

For group audit engagements questions related to the following are added:

The group auditor will determine whether the work performed by component auditors is adequate for purposes of the group audit. If inadequate, the group auditor should determine additional audit procedures and whether they are to be performed by the component auditors or by us.

Refer item below that provides information about how additional procedures can be added to the work program.

|

|

Conclusion – revise audit plan and additional procedures

|

|

When users conclude that assurance obtained from work performed by component auditors is inadequate for purposes of the group audit, the users should elect revision of the audit plan in the “Conclusion” section. A new procedure namely “Additional procedures” can be selected, and users can add audit procedures based on the circumstances.

After completion of the additional procedure(s), the group auditor will determine the assurance obtained from the additional procedures and that result will be used when determining the estimated audit risk remaining.

|

|

18.10 Financial statement preparation work program

|

|

Consolidation process

|

ISA600.38(a) & (b)

|

The user will be required to perform the procedures related to the consolidation process on 25.10G (New) Consolidation process work program.

|

|

25.10G (New) Consolidation process work program

|

|

Inclusion and objective of 25.10G (New)

|

ISA600.38-40, 43 & 44

|

Only applies to group audit engagements.

The objective of the document is to perform the audit procedures to meet the requirements of ISA 600 (Revised) par 38-40, 43 and 44.

25.10G (New) is a general work program that should always be completed. 25.10G(New) is deemed an extension of 18.10 Financial statement preparation work program.

|

|

Warning – Framework specific audit procedures

|

|

For the 2024 release accounting framework specific procedures related to consolidated financial statements have not been updated or added.

To remind users of this exclusion, the following warning is added to affected work programs for Group Audit M and Group Audit S:

"Audit procedures to address the requirements related to consolidated financial statements in accordance with "description of framework" have not been updated or included. Review the work program and add and amend procedures as deemed appropriate."

Affected work programs are 25.10G, 321.10, 327.10, 328.10, 790.10 and 830.10.

|

|

Subsidiaries – Additions, disposal and change in interest

|

|

Basic audit procedures related to additions, disposal or change in interest will be included based on newly added questions in 10.50 Gathering of information.

|

|

Sub-consolidation procedures

|

|

Audit procedures related to sub-consolidations are included based on the response of the newly added question in 10.50 Gathering of information.

|

|

Conclusion questions

|

|

In addition to the conclusion questions that are included for general work programs, the conclusion questions under work programs for COTABDs noted above are also included, as well as “Fraud or fraud risk factors that could have an impact on fraud risk assessment.”

|

|

26.10G (New) Evaluation of component auditor’s work

|

|

Inclusion and objective of 26.10G (New)

|

|

Only applies to group audit engagements.

The objective of the document is to evaluate the component auditor’s communication and the adequacy of their work in ccordance with ISA 600 (Revised) par 45-47.

26.10G (New) is a general work program that should always be completed.

|

|

Conclusion

|

ISA600.46(b)

ISA600.48

|

In addition to the conclusion questions that are included for general work programs, the conclusion questions under work programs for COTABDs noted above are also included, as well as “Fraud or fraud risk factors that could have an impact on fraud risk assessment.”

The group auditor will determine whether:

|

3.3.12 Finalisation

|

Matter identified

|

ISA ref

|

Comment

|

|

02.00 Partner sign-off

|

|

Leadership responsibilities for managing and achieving quality on a group audit

|

ISA600.16(b)

|

The partner declaration has been updated with further declarations based on the “engagement partner shall” paragraphs in ISA 600 (Revised) that applies to the execution and completion of the group auditor.

For example that the engagement partners determined that they were sufficiently and appropriately involved in the work performed by the component auditors to provide them with a basis for determining that the significant judgments made and conclusions reached are appropriate.

|

|

02.50 Consideration of assurance reports

|

|

Auditor’s report on consolidated financial statements

|

ISA600.53

ISA700.38(c)

|

Questions related to the group audit were added, for example description of the responsibilities of the group auditor (ISA700.38(c) and determination that reference is not made to the component auditor, unless required by law or regulation (ISA600.53).

|

|

02.90 Report to management and those charged with governance

|

|

Communication with group management and those charged with governance of the group

|

ISA 600.57

|

02.90 Report to management and those charged with governance includes the matters that ISA 600 (Revised) par 57 requires the group auditor to communicate to TCWG, for example the overview of the work to be performed at the components of the group and the nature of the group auditor’s involvement in the work to be performed by the component auditors.

|

|

Auditor’s independence

|

ISA 260.17

|

Paragraphs were added for listed and non-listed entities.

|

|

02.92 Letter of representation

|

|

|

|

For ‘Audit Group Multiple, the term ‘consolidated financial statements are used.

|

3.3.13 NEW Identification of components

10.20 Engagement evaluation now includes questions for group audit engagements to identify components. As part of client acceptance and continuance for group audit engagements, users will be required to identify components, i.e. “entity, business unit, function or business activity, or some combination thereof, determined by the group auditor for purposes of planning and performing audit procedures in a group audit” (ISA 600 (Revised) par 14 (b)).

Group auditors identify components during client acceptance and continuance to determine at which entities or business units, individually or in combination, audit work is expected to be performed, to determine the resources needed, including the involvement of component auditors. Together with the other information gathered during client acceptance or continuance, group auditors will use the information gathered related to the components and component auditors to determine whether they expect to obtain sufficient appropriate audit evidence to provide a basis for forming an opinion on the group financial statements (ISA 600 (Revised) par 17).

Components are not necessarily a reflection of the legal structure used to consolidate; components can be a combination of entities or business units. Based on their understanding of the group, including matters such as similar business characteristics, operating in the same geographical location, under the same management, and using a common system of internal control, group auditors consider whether the financial information of certain entities or business units included in the group's organisational structure can be considered together for planning purposes and further audit work to be performed (ISA600.4-5 & A6-9).

The following actions are performed in Probe to identity and record components:

1. Obtain an understanding of the group and its environment and identify all entities and business units forming part of the group. Document details of them on 11.20G (New) Identification of components, using the new “Add Entity” feature. Extended users are provided with additional columns to document details of entities and business units.

2. Consider whether the entities and business units within the group have similar activities or business lines, and whether the group has centralised activities or common controls. Users record whether any of the aforementioned exist in the new section ”Plan extent of risk assessment procedures” on 10.50 Gathering of information.

3. Based on their understanding of the group, users determine whether entities or business units can be considered together and assign the identified entities and business unit to components. Users add components using the new “Add Component” feature. The description of the components added will be available for selection in a dropdown list in the “Assign to component” column.

Only entities and business units as well as the components added on 11.20G will be available for selection in other documents such as 10.50G and 12.20G.

3.3. 14 Preliminary assessment of resources

10.20 Engagement evaluation now also includes questions for group audit engagements to identify the components at which it is expected that audit work will be performed to determine availability of required resources and whether unrestricted access to those components and the component auditors is possible (ISA 600 (Revised) par 22). As explained in par 3.3.13 the information may impact the decision to accept or retain the client.

To determine the components at which it is expected that audit work will be performed, and the resources needed, users complete:

-

10.50G (New) Plan extent of risk assessment procedures to determine per COTABD whether it is a “Consolidation balance only”, whether audit work will be performed centrally and the involvement of component auditors in RAP, taking into account whether audit work is expected to be performed centrally. Refer par 3.3.14 below for an explanation on the completion of 10.50G.

-

12.20 Audit plan and strategy and 12.20G (New) Further audit work at component level to determine the level at which further audit work will be performed. Refer par 3.3.18 below for further detail.

The above determination of involvement of component auditors is a preliminary determination for purposes of client acceptance and continuance. The group auditor will revisit this determination after gathering further information and performing further RAP during planning. Users are prompted to document their understanding on the appropriate planning document, instead of 10.20 Engagement evaluation, to prevent duplication of effort. This approach recognise that the iterative planning process may require group auditors to update their understanding as they complete the audit plan, and the documentation thereof.

3.3.15 NEW Plan extent of risk assessment procedures

RAP can be performed centrally or component level, by group auditors or component auditors or combination thereof. Refer to par 3.3.1 for explanations of these terms. The group auditor can involve component auditors in the design and performance of risk assessment procedures.

To assist with the determination of whether risk assessment procedures will be performed by the group auditor, component auditors or a combination, the following actions are performed:

-

Determine whether COTABD is a “Consolidation balance only”. The group audit will obtain the understanding of these balances, required by the ISAs. In the following instances, the answer to “Consolidation balance only” will be populated as “Yes” on 10.50G, because it is required that the group auditor performs audit work in accordance with relevant ISAs:

The users will not be able to change the “Yes” response.

-

Determine whether the balance of the COTABD is based on accounting estimates or fair value measurement. Whether the understanding of the accounting estimates will be obtained by the group auditor, component auditor or combination, will be influenced by determination of “Consolidation balance only” and whether it is expected that audit work will be performed centrally.

-

Determine whether audit work can be done centrally: When users determined that there are centralised activities or common controls, users will perform the following on 10.50G (New) Plan extent of risk assessment procedures:

-

Select whether it is expected that audit work will be performed centrally, taking into account the information related to similar activities and business lines, group centralised activities and group common controls. This determination informs the determination on 11.20G whether entities and business units can be considered together with others for planning and performing audit work. When it is expected that audit work will be performed centrally, the group auditor will obtain the understanding of the COTABD as required by the ISAs, with or without the involvement of component auditors.

The selections in 10.50G (New) determine the inclusion of content in the following documents:

3.3.16 Gathering information of COTABDs

The firm can elect in FIRMSETT Probe Firm Settings to what extent the group auditor obtains an understanding of the COTABDs included in the group financial statements versus placing reliance on the work performed by component auditors to gain the understanding. This approach considers that RAP can be done centrally or component level, and it can be performed by the group auditor, component auditors or a combination thereof, as noted above.

The table below explains the impact of each option in 10.50 Gathering of information and 10.51 Types and volumes of transactions:

|

Election in FIRMSETT

|

10.50 Gathering of information

|

10.51 Types and volumes of transactions

|

|

Required for all group audits - multiple entities

|

Complete all the questions on 10.50 from the perspective of the consolidated financial statements and group audit.

For example, the question “Are any assets held by third parties?” will always be included in 10.50.

|

The sub-sections “Transaction and balances” will be included for all COTABDs with current year or prior year balances.

|

|

Not required

|

The questions related to specific COTABDS will only be included when the group auditor identified on 10.50G that the:

For example, the question “Are any assets held by third parties?” will only be included in 10.50 when users selected for example that Property, plant and equipment or Inventory will be audited centrally.

|

The sub-sections “Transaction and balances” will be included for the specific section identified on 10.50G that the:

|

|

Elected per group audit - multiple entities

|

The group auditor should answer the following question:

Are we planning to complete the following from a group financial statement perspective:

When answered “Yes”, complete all the questions on 10.50 (similar to the option in FIRMSETT – Required for all group audits).

When answered “No”, the inclusion of the questions will be similar to when it was elected in FIRMSETT – Not required.

|

When answered “Yes”, The sub-sections “Transaction and balances” will be included for all COTABDs with current year or prior year balances. (similar to the option in FIRMSETT – Required for all group audits).

When answered ”No”, the inclusion of the questions will be similar to when it was elected in FIRMSETT – Not required.

|

Further explanation related to Audit Group Multiple/Not required or Elected per group audit - multiple entities and “No” on 10.50:

The questions that relate to COTABDs on 10.50 applies to some COTABDs, not all. For example, assets held by third parties relate to Property, Plant and Equipment (PPE), but not Trade and other payables. For Audit Group Multiple, the questions that relates to a COTABDs should be included on 10.50 when:

-

The question relates to the COTABD , and

-

Any of the following for the COTABD was selected on 10.50G:

- Consolidation balance only, or

-

Plan to perform centrally.

Reason being the group auditor obtains the understanding of the COTABD as the group auditor may perform further audit work on that COTABD pending risk identification and assessment, and determination of the selected assertion of a material COTABD without any inherent risk.

Looking at the earlier example of the 'assets held by third parties' question. The question will not appear when users selected either 2(a) or (b) above for Trade and Other payables on 10.51, since the question does not apply to Trade and Other payables.

In the case of PPE, the question will appear if either 2(a) or (b) was selected.

Questions that relate to ISA requirements and questions expected to be answered by the group auditor because audit work is expected to be performed centrally, and not component level, will always be included in 10.50.

3.3.17 Information system and control activities

11.50 Information system and control activities was updated to include the following:

-

Centralised activities and common controls (New)

The content of the new section “Centralised activities and common controls” will be based on the answers in section ”Plan extent of risk assessment procedures” on 10.50 Gathering of information.

When users selected in 10.50G that the centralised activities or common controls relates to a COTABD, and an inherent risk was recognised for the relevant COTABD (i.e. it is considered a SCOTABD), users will be prompted to document their understanding in the relevant SCOTABD section in 11.50.

-

For SCOTABD sections

Take note that the inclusion of the above content is based on the selection ‘Centralised activities’, or ‘Common controls’ in 10.50G and not ‘ Plan to perform centrally’ in 10.50G, which is the basis of the inclusion of questions in 10.50 and 10.51. The reason for this ‘different’ treatment is that ISA 600 (Revised) par 30 (c)(i) & (ii) requires the group auditor to take responsibility for obtaining an understanding of the group’s system of internal control related to nature and extent of common controls and group centralised activities. It is expected that the group auditor will obtain the understanding since the common controls and centralised activities is established and managed by group management. The group auditor may elect to involve component auditors in obtaining the understanding, but it is not expected that component auditors will obtain the understanding on their own.

3.3.18 NEW Further audit work at component level

In 12.20 Audit plan and strategy the auditor is required to formulate an audit plan for each SCOTABD and material COTABD without an inherent risk. Probe Audit requires the auditor, including the group auditor, to select and test at least one assertion for material COTABD for which no inherent risk has been identified. (ISA 600 (Revised) par 22).

For each SCOTABD and material COTABD on 12.20 Audit plan and strategy the group auditor will be prompted to complete 12.20G (New) Further audit work at component level to determine at which level the audit work will be performed.

12.20G (New) Further audit work at component level, is deemed an extension of 12.20 Audit plan and strategy. The following actions will be performed:

-

Level at which audit work will be performed

For each SCOTABD and material COTABD users will determine on 12.20G whether further audit work should be performed for each component identified and added on 11.20G. Users will select from the following dropdown options:

During preliminary planning and performing risk assessment procedures, group auditors were required on 10.50G to determine whether it is a “Consolidation balance only” and to make a preliminary determination whether they plan to perform further audit work centrally. This selection made on 10.50G will be included in each section in 12.20G to be considered by the group auditor when determining at which level further audit work should be performed.

For the extended users, group auditors will be prompted to consider the factors that may influence the group auditor’s determination at which components further audit work should be performed (ISA600 (Revised).A51).

For example, users are prompted to consideration whether the risk identified on the group financial statements relates to a specific entity or business unit. Users can refer back to 11.60 Risk assessment at assertion level that provides information of whether the recorded risks relate to a specific entity or business unit. In case of a material COTABD, this column will be pre-populated with a “N/A” response.

-

Scope of work at components and resources

The components where further audit work is required to be performed by the component auditor, with or without the group auditor, will pull through to “Scope of work at components and resources”. For each of these components, the group auditor determines and document the nature, timing and extent of audit work to be performed.

For the extended users, group auditors will be prompted to

The extended users are also provided with a summary of the level of audit work per COTABD that is required to be performed per component.

3.3.19 Audit plan and strategy

Each COTABD now also include Group audit considerations and group audit procedures. The selection of “Perform audit work at which level” in 12.20G (New) Further audit work at component level, will pull through to 12.20 Audit Plan and strategy.

Two new audit procedures are added, namely “Use of component auditors” and “Consolidation process”:

-

Use of component auditors

When users elected on 12.20G (New) Further audit work at components that component auditors will be used to perform further audit work, with or without the involvement of the group auditor, the new group auditor procedures “Use of component auditors” will be ticked in 12.20 Audit plan and strategy.

-

At component level (only)

When users elected that audit work will only be done at component level, “Required procedures” will not be auto-ticked, “Extended analytical review”, “Extended test of detail” and “Substantive sampling” will not be available for selection.

The audit work for the relevant COTABD will be performed at component level. The group auditor will not perform audit work, other than “Use of component auditors” and “Consolidation process” when an inherent risk related to the consolidation process for that COTABD has been raised.

-

Centrally or centrally with component auditors

Extended analytical review and the other audit procedures mentioned above will be available for selection when users elected “Centrally with component auditors” or “Component Auditors”. “Required procedures” will be auto-ticked as the group auditor will perform audit work, with or without the component auditors.

-

Consolidation process

“Consolidation process” in the relevant section in 12.20 will be auto-ticked when the user selected “Consolidation process” in the risk button.

The user will be required to add audit procedures in the relevant work program to obtain sufficient and appropriate audit evidence to address the ROMM at assertion level that relates to the consolidated process.

5. Significant risks

When a significant risk was raised, the “Significant risk response” will be auto-ticked.

6. Tests of controls

Audit procedure “Tests of control” continue to be auto-ticked when the user indicated in the “Record Control” that reliance on control is intended.

3.3.20 Use of component auditors – work programs

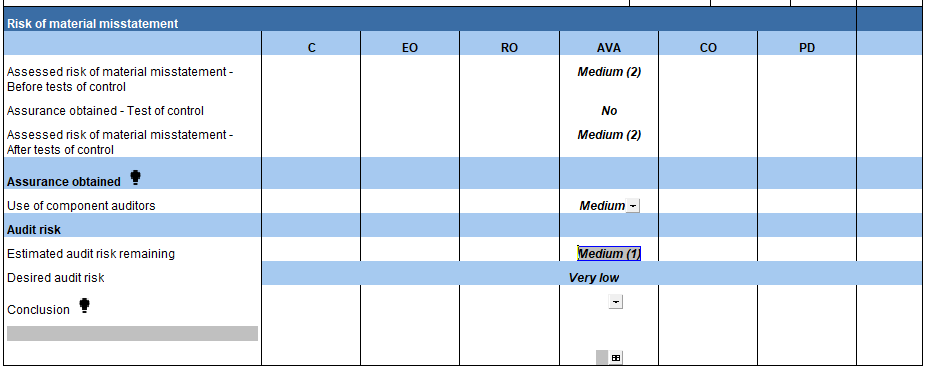

When “use of component auditors’ is ticked in 12.20, audit procedure under the heading “Use of component auditors” will be added to the relevant work program.

Conclusion questions were added to consider whether the work performed by the component auditors is adequate for the purposes of the group audit.

Users will be required to determine the assurance obtained through the work performed by the component auditors. Users should take assessment into account in determination of the audit risk remaining.

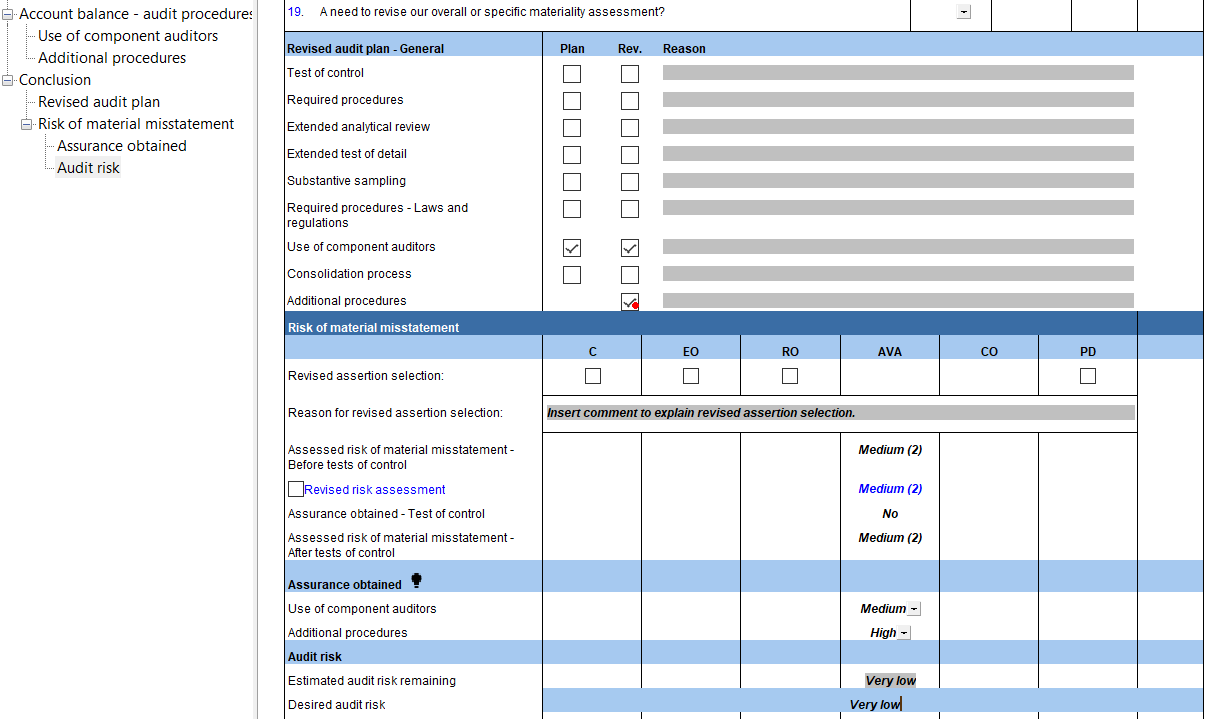

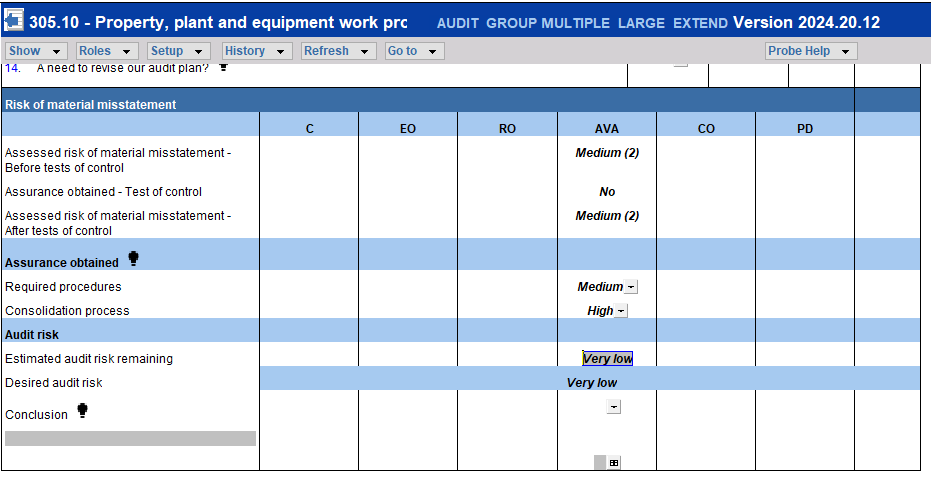

When the group auditor concluded that assurance obtained from component auditors are not adequate, the user should select “Yes” to “A need to revise audit plan?” and “General including laws and regulations”

Under “Revised audit plan-General” a new type of audit procedure “Additional procedures” is added.

When the user selects “Additional procedures”, the user is prompted to add audit procedure(s).

After completion of the additional procedure(s), the group auditor will determine the assurance obtained from the additional procedures and that should be taken into account when determining the estimated audit risk remaining.

3.3.21 Consolidation process – work programs

When “Consolidation process” is auto-ticked on 12.20, the relevant work program will include a prompt to add audit procedures to obtain sufficient and appropriate audit evidence to address the ROMM at assertion level that relates to the consolidated process.

The user will be required to complete “Assurance obtained” for “Consolidation process”.

3.3.22 Compliance Add – On (South Africa only)

For engagement type “Group Audit M”, the group auditor can elect in 10.20 whether they want to include the Companies Act procedures in the engagement file. This approach recognises that the Companies Act procedures are applicable to a company. The Companies Act procedures that address the requirements related to presentation and disclosure in the financial statement, that also applies to group financial statements, will always be included in 18.10 Financial statement presentation work program for “Group Audit M”.

The inclusion of the Companies Act procedures for “Group Audit S” and “Audit S” is similar to the treatment in the 2023 and earlier market versions, i.e.

The answer to the question in 10.20 Engagement evaluation inter alia includes questions or procedures on the following documents:

3.4 IRBA Enhanced Audit Reporting Rule (South Africa only)

The IRBA Rule on Enhanced Auditor Reporting for the Audits of Financial Statements of Public Interest Entities, published in Government Gazette No. 49309 dated 15 September 2023 (EAR Rule) is effective for audits of financial statements for periods ending on or after 15 December 2024, with early adoption permitted.

The EAR Rule prescribes additional disclosures in the independent auditor’s report on the audit of annual financial statements of Public Interest Entities (PIEs), as defined in the IRBA Code of Professional Conduct for Registered Auditors (Revised April 2023), as amended. The Revisions to the IRBA Code of Professional Conduct for Registered Auditors (Revised April 2023) issued in November 2023 was applied.

|

Matter identified

|

ISA ref

|

Comment

|

|

10.20 Engagement evaluation

|

|

Public interest entity (PIE)

|

|

A question was added to determine whether the entity was classified as a public interest entity when it is determined to be one of the entities on the list of entities deemed to PIEs in accordance with R400.23(SA). The list of entities deemed to be PIEs in accordance with R400.23(SA) is included as an instruction.

The definition of the public interest entity included as guidance text has been updated based on the revised definition in ‘The Revisions to the IRBA Code of Professional Conduct for Registered Auditors (Revised April 2023)’ issued in November 2023.

|

|

02.50 Consideration of assurance reports

|

|

Public interest entity (PIE)

|

|

Procedures related to the additional disclosure required in the auditor’s report of the financial statements of a PIE, were added.

These procedures will only be included when user selected yes to the PIE question in 10.20.

|

|

02.55 Key Audit Matters

|

|

Key Audit Matters table

|

|

When recording a KAM, users will be required to complete the following two new data fields when users answered “Yes” was to PIE question in 10.20:

The detail will pull through to the Key Audit Matters table on 02.55, and the auditor’s report in the financial statements when user concluded that the KAM will be reported on in the Auditor’s Report.

|

3.5 Other

3.5.1 Financial reporting frameworks

The IFRS Foundation® Trade Mark Guidelines, in accordance with the International Auditing and Assurance Standards Board’s (IAASB) International Accounting Standards Board (IASB) Liaison Working Group Publication, have been implemented.

The term IFRS in 10.20 was replaced with “IFRS Accounting Standards as issued by the International Accounting Standards Board”, and similarly the term “IFRS for SME” was replaced with “IFRS for SMEs Accounting Standard as issued by the International Accounting Standards Board”.

3.5.2 02.55 Key audit matters

The following audit procedures were added to 02.55.

The engagement partner sign-off on 02.55 was deleted and a declaration by the engagement partner related to KAMs isare included in the “Engagement partner declaration” on 02.00.

3.5.3 11.60 Uncategorised risks

We have included additional functionality to document 11.60 that will indicate to the user when they have a risk that exists that does not belong to any of the existing sections. At the top of the document, you will see a section called uncategorised risks where these risks will be stored. To reallocate these risks to the correct section, you need to edit that risk and select the section you require it to be allocated to or you can choose to delete the risk if it no longer serves a purpose

3.6 Known matters

3.6.1 Differences between total assets and total liabilities in 10.52 and 02.40

There is a difference between the figures of total assets in 10.52 - Preliminary analytical review and 02.40 - Evaluation of misstatements, this relates to technical assets that appear in 10.52 - Preliminary analytical review and not in 02.40 - Evaluation of misstatements. This will be fixed in the next release.

There is a difference between the figures of total liabilities in 10.52 - Preliminary analytical review and 02.40 Evaluation of misstatements, this relates to deferred tax being offset in 02.40 - Evaluation of misstatements and not in 10.52 - Preliminary analytical review. This will be fixed in the next release.

3.6.2 11.60 - Blank risks under Uncategorised section

Upon opening document 11.60, you may note that you have two blank risks under the uncategorised risks section. We have noted this and it can be resolved by opening document 11.20G and closing it, then refreshing risk tables in 11.60. We will resolve this issue in the next release.

3.6.3 11.60 and 10.70 – Blank risks/LTBMs identified

When in an audit engagement, 11.60 has an issue where all newly created risks are created twice. Once for the risk you raise and a second one that appears as blank. You may delete the second one that shows as a blank risk. When in a review engagement, the same issue exists in 10.70 and can be resolved the same way by deleting the blank LTBM. We will rectify this issue in the next release.

3.7 Previously reported items fixed with Hotfixes

https://success.casewareafrica.com/articles/Knowledge/Probe-Hotfix

The following list is a brief description of fixes that have been made though hotfixes:

3.7.112.20 – Audit plan and strategy

The risk assessment at financial statement levels and the overall response increase extent of work on all relevant and selected assertions, are not populating automatically from 11.20, 11.25 and 11.30.

3.7.2 20.10 – Laws and regulations work program

3.7.3 02.00 – Partner sign-off

4. Review

No changes were made to Review in this release.

5. Compilation

No changes were made to Compilation in this release.

6. Updated document summary

Please download the full release notes to view the updated document summary.

If you are a firm champion or firm template author, you will have access to your unique download package by accessing the My Software page and clicking on the download packager icon top right. If you are responsible for managing updates and have not received login details for the CaseWare Africa Success Community, click on Login (top right) and then choose the Register Now option.

If this is not successful contact our admin team at info@casewareafrica.com

the firm champion?

- The "Firm's Champion" is the staff member responsible for rolling out the template to the users at the firm.

I do have a CaseWare Africa Success Community login

- If you are a firm champion, you will have access to your firm's unique download package by accessing the My Software page and clicking on the download packager icon (top right).

I do have a CaseWare Africa Success Community login but cannot see the My Software option

- You may request the file to be provided to you by your firm champion.

- Alternatively to obtain this access your firm champion will need to update your user permissions on the Content Management page once they have logged in. This page is available when selecting the My Team's Information option in the drop down menu. When clicking on the Manage button next the user's name, ensure that the Download Software checkbox is ticked. This will allow the user access to the My Software page.

I don't have a CaseWare Africa Success Community login

- If you are responsible for managing updates and don't have a login for the CaseWare Africa Success Community, click on the Login button in the top right and then Register Now.

- If this is not successful contact our admin team at info@casewareafrica.com

Rate this article: