Auditor Setup of the ZA-Liability form

The ZA-Liability form provides information on balances, interest, covenant details and any collateral, securities or facilities that may be attached to an account for a specified year end date.

It is important to note that should an account have an attached overdraft facility, the responder will be able to provide this information, as well as the relevant overdrawn balance and interest owed, on the ZA-Asset form.

By referring to the responder instructions, users will be able to determine which type of accounts they can send for the ZA-Liability Form. Common examples of liability accounts are typical loans and advances.

Auditor Setup of the ZA-Liability form

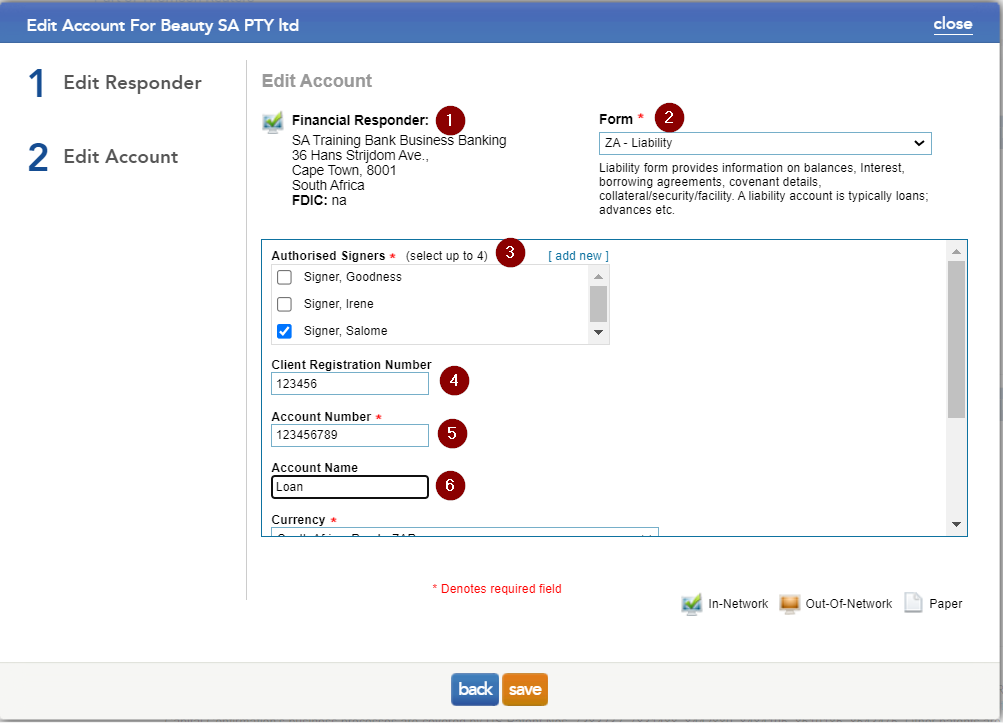

The following image provides a detailed description of what is required for the different fields.

Instructions:

-

Financial Responder: This block provides the full address of the financial institution the requests will be sent.

-

Form (mandatory field): Select the specific form you wish to submit through to the bank.

-

Authorised signers (mandatory field): Select the client signer(s) that is the bank mandated signer(s) for this account.

-

Client Registration (mandatory field): This is the registration number a company receives when the business is registered. NPOs will be require a NPO number and sole proprietors will need to provide the owner’s ID number.

-

Account No (mandatory field): This is the account number as per client’s bank statement or CIPC document.

-

Account Name: This is the account name as per the client’s bank statements.

Completed ZA-Liability form

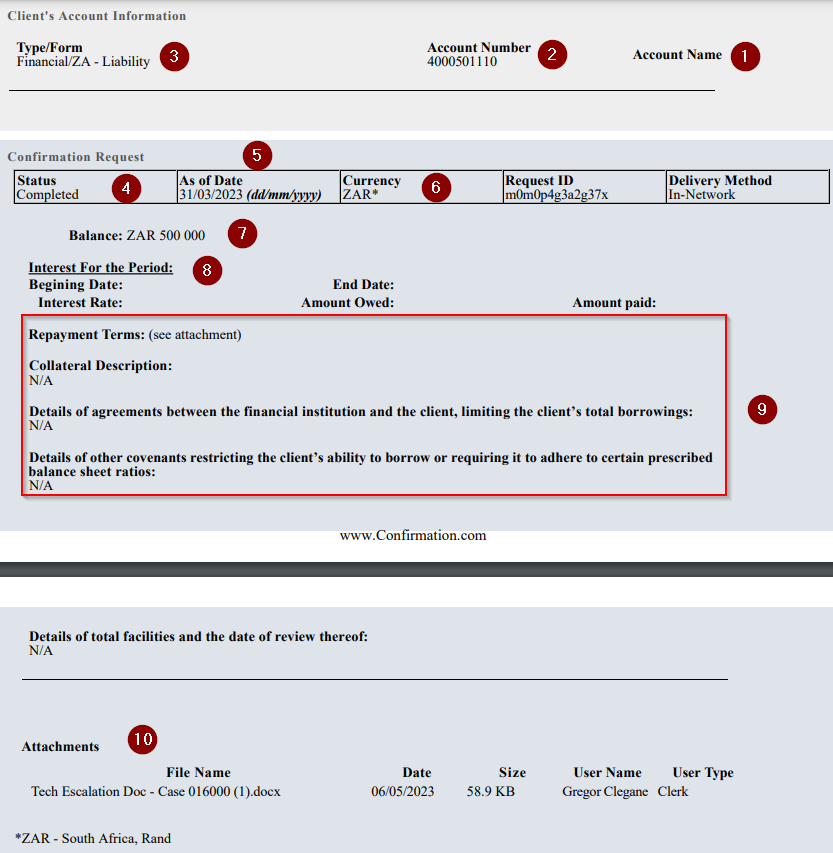

The below image describes what the ZA-Liability form will look like once the bank has completed the form. The image also highlights where the auditor needs to focus on to obtain the information they require to complete their audit.

-

Account Name: This is the account name as per what was provided by the auditor.

-

Account Number: This is the account number as per what was provided by the auditor.

-

Type/Form: This is the type of form that was sent through to the financial responder.

-

Status: This field indicates if the request was complete or denied by the financial responder.

-

As of Date: This is the year end date selected by the auditor.

-

Currency: This is the currency that the auditor selected for the specific form.

-

Balance: This is provided by the responder as of the requested year end date.

-

Interest for the period: Responder provides the interest attached to the requested account over a specified period. Often the responders will provide a detailed interest schedule as an attachment.

-

Questions specific to the form type: These are questions that the Responder will respond to on the form. Often the responder will provide attachments as solution to the questions.

-

Attachments: The responder has the option of attaching documentation to further assist the auditor.

Rate this article:

|vote=None|

Processing...

(Popularity = 67/100, Rating = 0.0/5)

Related Articles

Guide ZA-Contingent Liability & Guarantees

User Profile for Bank Users Set Up

Investec Private Bank South Africa Audit Confirmation Instructions

ABSA Corporate Bank South Africa Audit Confirmation Instructions

view all...

Search Results

Guide ZA-Cash Management Form

Confirmation Billing Guide (Effective 1 Nov 2025)

Guide ZA-Liability Form

Guide ZA-Asset form

Guide ZA-Bills Form

view all...