ZA- Letter of Credit

The ZA-Letter of Credit form provides information in relation to a letter issued by a responder to another responder to serve as a guarantee for payments made to a specified person under specified conditions

By referring to the responder instructions, users will be able to determine what type of accounts they will need to send for the ZA-Letter of Credit form.

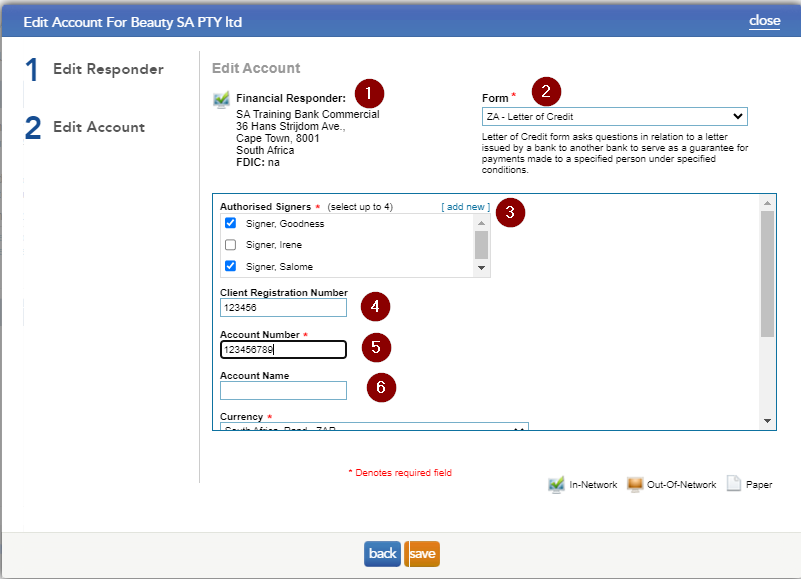

Auditor Setup of the ZA-Letter of Credit form

The following image provides a detailed description on what is required for the different fields

Instructions:

-

Financial Responder: This block provides the full address of the financial institution the requests will be sent.

-

Form (mandatory field): Select the specific form you wish to submit through to the bank.

-

Authorised signers (mandatory field): Select the client signer(s) that is the bank mandated signer(s) for this account.

-

Client Registration (mandatory field): This is the registration number a company receives when the business is registered. NPOs will be require a NPO number and sole proprietors will need to provide the owner’s ID number.

-

Account No (mandatory field): This is the account number as per client’s bank statement or CIPC document.

-

Account Name: This is the account name as per the client’s bank statements

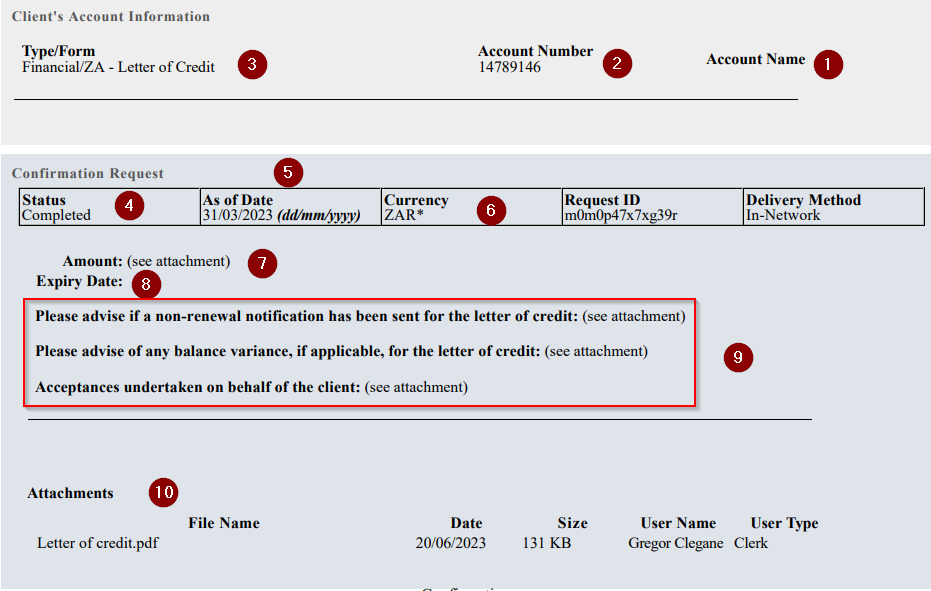

Completed ZA-Letter of Credit form

The below image describes what the ZA-Letter of Credit form will look like once the bank has completed the form. The image also highlights where the auditor needs to focus on to obtain the information they require to complete their audit.

-

Account Name: This is the account name as per what was provided by the auditor.

-

Account Number: This is the account number as per what was provided by the auditor.

-

Type/Form: This is the type of form that was sent through to the financial responder.

-

Status: This field indicates if the request was complete or denied by the financial responder.

-

As of Date: This is the year end date selected by the auditor.

-

Currency: This is the currency that the auditor selected for the specific form.

-

Amount: This is provided by the responder as of the requested year end date.

-

Expiry Date: Responder provides the relevant expiry date.

-

Questions specific to the form type: These are questions that the responder will respond to on the form. Often the responder will provide attachments as solution to the questions.

-

Attachments: The responder has the option of attaching documentation to further assist the auditor.

Rate this article:

|vote=None|

Processing...

(Popularity = 3/100, Rating = 0.0/5)

Related Articles

How to set up a form for responders in South Africa?

Guide ZA-Contingent Liability & Guarantees

How do I set up a Consolidation/Group figures in Caseware Working Papers?

User Profile for Bank Users Set Up

view all...