The planning figures read off the Opening balance and the transactions column, so you can use the "Other entries" to pass journals from an accounting point of view.

The reason why we do not use the adjusting journals in the planning is that auditors pass journals throughout the audit, and this then affects the planning figures.

Answer:

To correct the above please follow the below steps:

1. Create a backup of the file by going to File| Backup| Select location| OK.

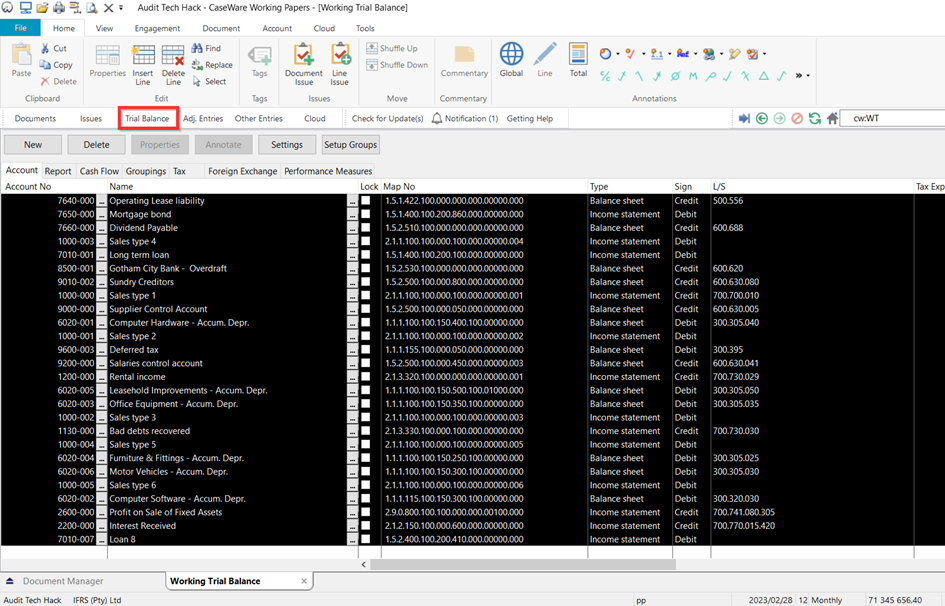

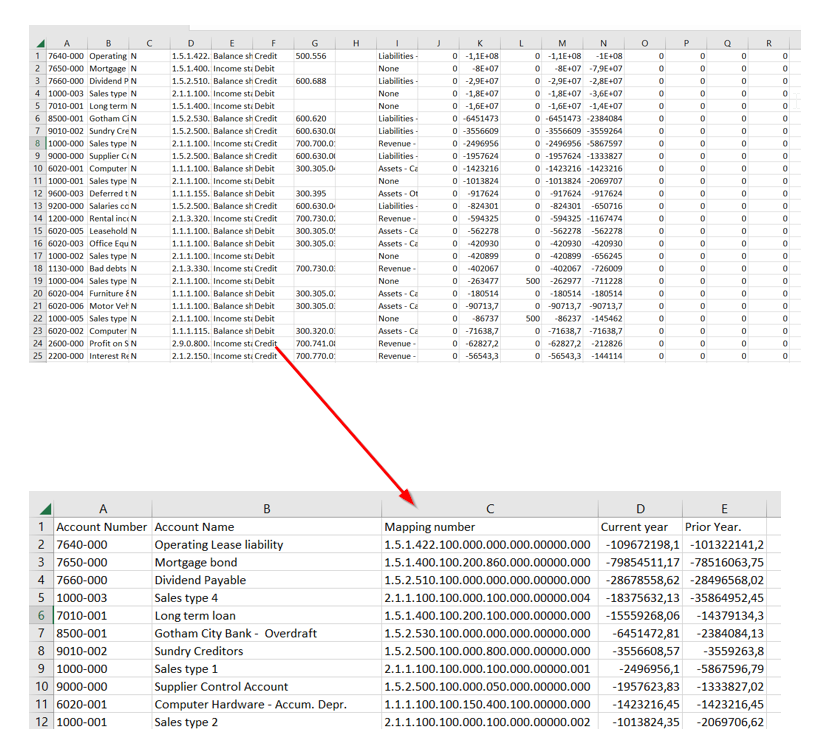

2. Copy the working trial balance to Excel by going to the Working Trial Balance| Ctrl+ A| CTRL

3. In Excel open a blank document and paste the copied information by using Ctrl + V. Enter column headers and delete what is not required for import i.e Lead sheet numbers and save the sheet.

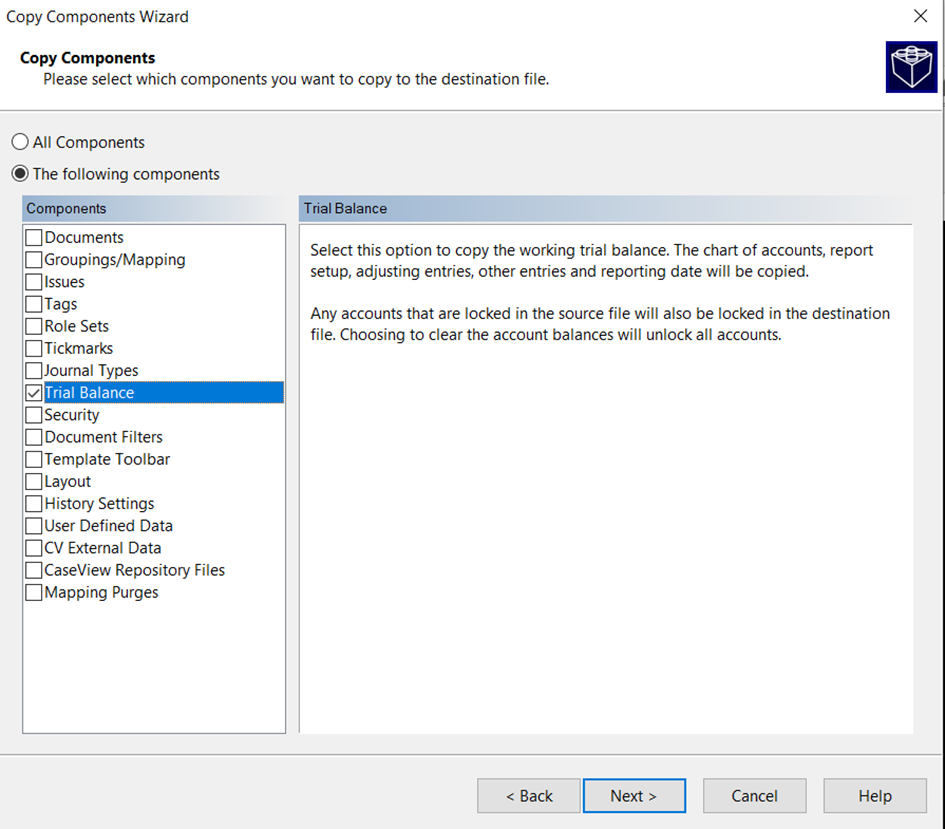

4. Clear the trial balance by File| Copy Components| The following documents| Trial Balance| Next| Finish.

5. Reimport the saved trial balance, selecting the final balance column as the current year.

Rate this article:

|vote=None|

Processing...

(Popularity = 0/100, Rating = 0.0/5)

Related Articles

Probe | Amounts not pulling through or pulling through incorrectly

Probe| How do I make figures show in my planning documents and adjusting entries?

Caseware Working Papers | How to use calculated journals and linking calculation to MS excel

Probe | Plan risk assessment procedures related to COTABDs and resources to be used

view all...

Search Results

Probe | In 12.20, why is my inherent, fraud and control risk at financial statement level assessment showing "blank" or "Not yet assessed"?

Probe Methodology | Planning Risk Assessment - 11.20 Inherent Risk Assessment

Probe Methodology | Planning Risk Assessment - 11.40 Fraud Risk Assessment

Probe | Planning Risk Assessment | 11.40 Fraud Risk Assessment

Probe | Planning Risk Assessment | 11.20 Inherent Risk Assessment

view all...